Municipal bonds fared better than expected throughout 2020 despite the global pandemic and subsequent impact on state and local government budgets. With record issuance and strong investor interest, muni bonds posted robust performance during the year and their yields have largely normalized since disruptions in March.

Let’s take a look at how muni bonds fared over the past year and what investors can expect in the new year.

Be sure to check out our Education section to learn more about municipal bonds.

Muni Bond Issuances in 2020

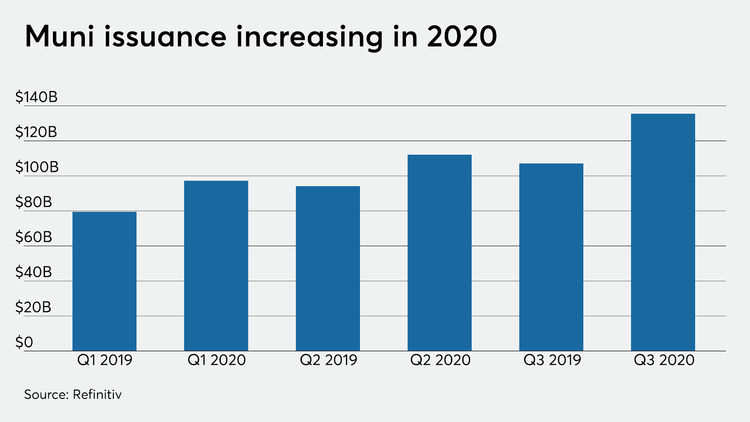

Municipal bond issuance is on track to reach a record $450 billion in 2020, according to RBC Wealth Management, beating 2017’s record $448.6 billion of issuance. After initially postponing issuances following the COVID-19 outbreak in March, municipal issuers came back in a big way to take advantage of low interest rates and strong investor demand (see below).

The Tax Cuts and Jobs Act of 2017 ended advance refunding of tax-exempt bonds with another tax-exempt new issue. With refunding accounting for the vast majority of growth in 2020, taxable issues remained proportionally elevated at 26% of total supply. These refundings have also been positive for credit quality since they lower debt service costs.

Click here to learn more about the municipal debt due diligence process.

Muni Bond Fund Flows in 2020

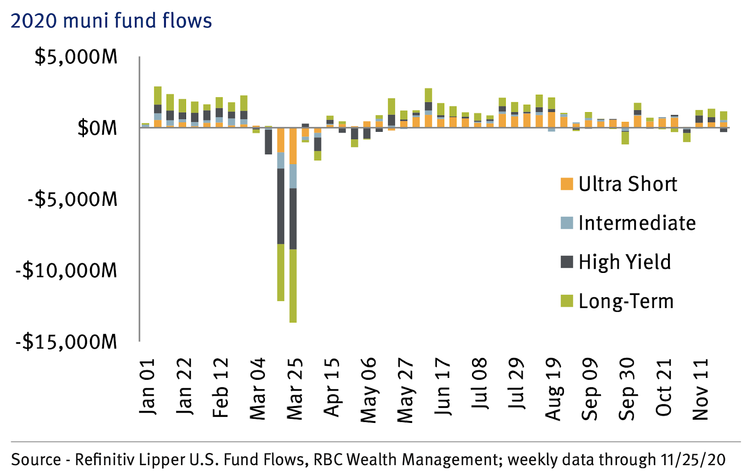

Municipal bond fund flows were strong coming into 2020 but outflows hit a record $44 billion in March following the COVID-19 outbreak (see below). However, with the Federal Reserve’s robust policy response, including zero interest rates, expansive quantitative easing, and the Municipal Liquidity Facility backstop, year-end inflows have surpassed $13 billion, making it a good year on the whole.

Investors have largely stuck with higher quality, lower yielding issuers given the high level of uncertainty, but defaults have been isolated and uncommon. That said, high-yield fund flows recovered toward the end of the year as investors blended higher yields into their portfolios to boost income during the new low interest rate environment.

Muni Bond Outlook for 2021

The municipal bond market should benefit from election certainty, positive vaccine news, and improved prospects for a stimulus package next year.

While many states will continue to struggle with weak revenue and budget strains, the Biden administration could provide further aid to states and tax receipts have been resilient in states with progressive income taxes.

Muni bond demand is also expected to outpace supply and benefit, which has made it easier for states to tap the markets to plug revenue shortfalls. The State of Illinois and the New York MTA were the only two entities that tapped the Fed’s Municipal Liquidity Facility, which means that its drawdown at year end will have limited impact on the wider market.

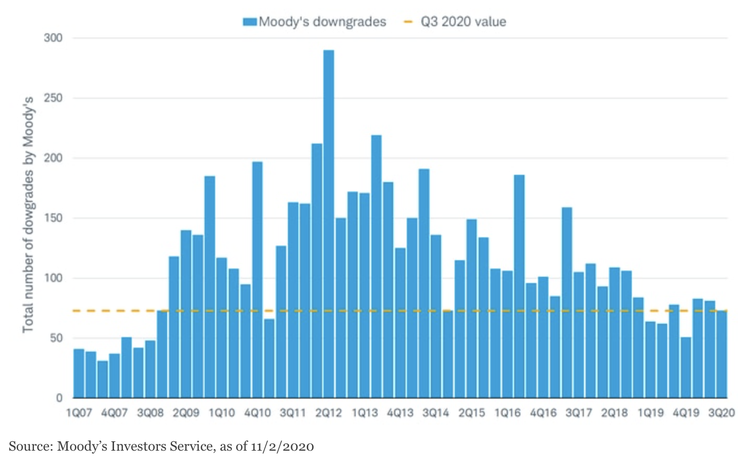

While broad defaults appear unlikely in 2021, there could be an increase in the number of credit downgrades as budget strains impact outlook. These downgrades could have an adverse impact on prices and lead to higher yields over time, but it’s worth noting that downgrades tend to lag the wider economy (as evidenced in the chart above).

To learn more about how credit rating agencies are assessing the financial health of various states, cities and other smaller municipalities, click here.

Updates on Important Themes

- General obligation (GO) bonds outperformed revenue bonds. In fact, nursing home and industrial development revenue bonds account for more than two-thirds of all muni bond defaults in 2020. Tax revenue has fallen across many states, but GO bonds remain relatively safeguarded in comparison to revenue bonds.

- Highly rated bonds outperformed lower rated bonds throughout most of the year as investors sought to de-risk their portfolios. The spread between high quality muni bonds and Treasuries fell to 126%, far more normal than March levels. High yield muni bonds have staged their own comeback but spreads remain higher by comparison.

- Chicago’s budget challenges have worsened due to the pandemic with a nearly $800 million budget deficit in 2020 and a projected $1.2 billion budget gap next year. While the city has identified some solutions, one-time measures alone may not be sufficient to address the projected shortfalls next year.

- New York’s MTA experienced a dramatic decline in ridership that’s projected to cause a $3.2 billion shortfall in 2020 revenue and a $5.8 billion shortfall in revenue next year. Despite these concerns, pledged revenue legally secures its bonds and state law prohibits a Chapter 9 bankruptcy, so bondholders face little real risk.

The Bottom Line

The municipal bond market performed better than many expected during the onset of the COVID-19 pandemic, although strained state budgets could lead to downgrades in the future. The good news is that incoming President-Elect Biden could provide some additional relief to states in the form of stimulus, although concrete plans remain to be seen.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.