Most consumers are acutely aware of rising inflation in their daily life, but the Federal Reserve’s response could extend that impact to their retirement savings. With fixed income becoming increasingly risky, many investors are looking toward the municipal bond market for opportunities to achieve higher after-tax yields.

Let’s take a look at how rising interest rates affect municipal bonds and how you can adjust your portfolio to hedge against risk.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Rising Rates & Muni Bonds

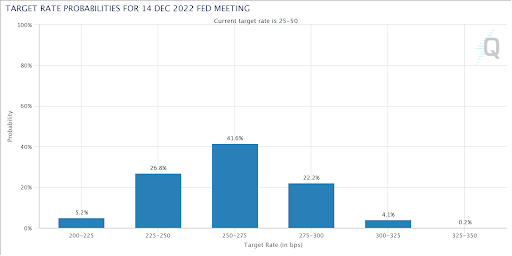

The Federal Reserve began raising interest rates earlier this year with a quarter-point hike in March and signaled it would do the same at all six remaining meetings in 2022. According to the CME’s FedWatch, the futures market currently projects a 42% probability that interest rates will reach 250 to 275 basis points by this year end.

The futures market predicts significantly higher interest rates this year. Source: CME Group

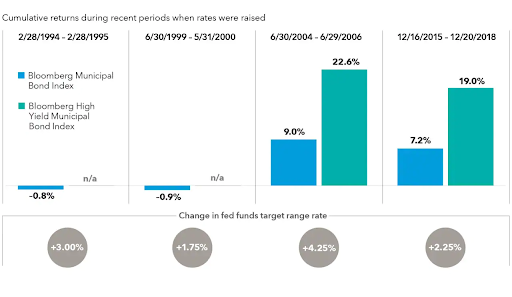

Most investors recognize that rising interest rates are bad for fixed income. After all, investors will naturally sell low-interest bonds for higher-interest bonds when rates increase. However, evidence suggests that’s not always the case for muni bonds. As you can see below, the last four times rates rose, muni bonds had limited downside—or even slight gains.

Rising rates aren’t always bad for the muni market. Source: Capital Group

That said, the S&P Municipal Bond Index is down 5.54% year to date, with shorter-duration bonds offering the best performance. At the same time, seasonal dynamics are likely to turn less favorable as new issues typically spike 16% in March, pushing the market toward a net positive supply. Therefore, investors may want to consider hedging their portfolios.

Don’t forget to check our Muni Bond Screener.

How to Hedge Your Portfolio

The municipal bond market remains strong from a credit standpoint. Many state and local governments have substantial revenue and reserve growth thanks to the economic recovery and federal aid packages. In particular, states with significant oil and gas production could benefit from rising commodity prices, resulting in higher tax revenue.

But, despite these bullish fundamentals, higher energy prices could hurt consumer spending and become a problem for local economic growth and employment over time. Meanwhile, higher inflation could hurt utilities if regulators find the price increases unaffordable. As a result, many investors are moving toward higher-quality bonds.

For instance, Peter Hayes, Head of BlackRock’s Municipal Bond Group, recently said that his firm favors neutral-duration bonds in the intermediate part of the yield curve. At the same time, they’re looking at higher quality bonds and selecting high-yield credits at attractive prices, favoring higher coupons, shorter calls, and defensive sectors.

In particular, Mr. Hayes says the most compelling opportunities may lie in state and essential service revenue bonds, property tax-funded schools, diversified health systems, and high yield issuers. Meanwhile, the firm is avoiding speculative projects, senior living, and long-term care facilities in saturated markets, given the higher levels of risk.

The Bottom Line

The municipal bond market offers a safe haven during rising-rate environments. While the broad muni market typically sees less downside when interest rates rise, investors can further hedge their portfolios by avoiding high duration bonds and higher-risk issuers. At the same time, low-risk revenue bonds could offer the best yields.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.