New changes in accounting standards for state and local governments regarding retiree healthcare costs and underfunded pension liabilities could have a significant impact on the prices of municipal bonds issued by these entities.

These dynamics could, in turn, impact the risk-adjusted returns for investors holding municipal bonds as part of their overall portfolios.

Unfunded Pension Liabilities

The Pew Charitable Trusts estimates that states had a $693 billion pension liability in 2015 (the latest year the figures are available), which was up five percent from 2014 and is expected to rise about six percent in 2015. With the aging baby boomer population, these costs are expected to continue to increase at an accelerated pace. The growth of these liabilities varies depending on the state and their individual policies.

Click here to learn more about how pension liabilities could impact the muni market.

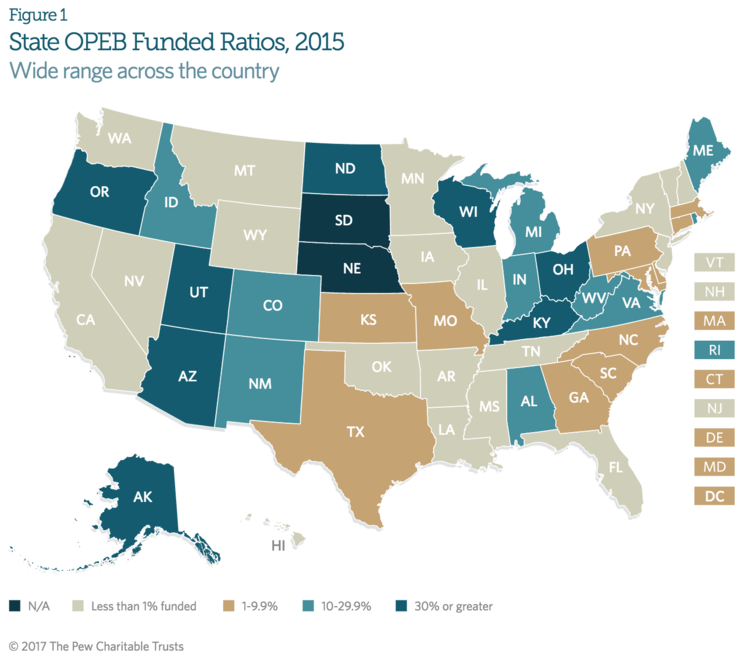

Most states appropriate revenue each year to pay retiree healthcare benefits rather than pre-funding the liabilities. States that provide retirees with a monthly contribution equal to a flat percentage of health insurance coverage premiums have the largest liabilities, while those that offer a retiree health plan with no subsidy have the lowest liabilities. The above figure shows the differences in other post-employment benefits (OPEB) funded ratios between various states.

The funded ratios show that much of a state’s total OPEB liabilities were funded by assets held in a trust. Higher funding ratios generally show greater stability, but bondholders must also consider the amount and growth of OPEB liabilities over time.

New GASB Accounting Rules

The Governmental Accounting Standards Board (GASB) is a private organization that sets the accounting and financial reporting standards for U.S. state and local governments. In fiscal 2018, the GASB will require states to list healthcare liabilities on their balance sheet rather than quoting them as off-balance sheet items. For example, New York State’s $17 billion in liabilities on its balance sheet would become $72 billion under the new rules.

States will also have to report OPEB expenses in place of the annual required contribution (ARC), which is calculated in a similar fashion to pension expenses under GASB Statement No. 68. Deferred inflows and outflows related to OPEB will also be reported on the balance sheet, which provides bondholders and the general public with much greater transparency in terms of the near-term and long-term cost of these liabilities.

These changes come in addition to the 2012 rules that were designed to improve the comparability and consistency of how governments calculate pension liabilities and expenses. Benefit payment projections were updated to include ad hoc post-employment benefit changes – such as COLAs – and underfunded pensions have to use high-grade municipal bond rates rather than investment portfolio returns when calculating coverage ratios.

Impact on Muni Bond Investors

The new rules could have a big impact on the municipal bond market. While some states won’t experience much change, such as Wisconsin, which has one of the best funded pension programs, others could see dramatic changes to their balance sheet and income statements. Higher balance sheet liabilities and lower reported income could lead to less confidence in muni bond issuers, lower bond prices and higher bond yields.

The new rules will create the appearance of a weaker financial position for many states with large underfunded pension liabilities. In particular, states like Illinois that are having trouble making their contributions could experience the biggest issues. For example, the City of Aurora saw about $150 million disappear from its balance sheet in December after recording the full cost of healthcare in the new year.

Alaska’s pension liabilities may be pre-funded to a larger extent than other states, but it has the highest ratio of liabilities to personal income at 42 percent. The state’s generous benefit levels can reach up to 90 percent of premiums for some retired workers, which means that it could report a significant liability on its balance sheet. States with generous programs like these may need to rethink their strategy following these regulatory changes.

In addition to perception, many states may be forced to take action to reduce or eliminate their healthcare benefits and other pension liabilities. Several states have already started reform talks, but there are many legal issues facing these changes. The Illinois Supreme Court, for example, invalidated a 2013 state pension reform law in May 2015, saying that the changes were not constitutional – a move that could make change more difficult in the future.

Check out our previous take on the trend of pension liabilities across different U.S states here.

Check out our take on due diligence strategies in the muni bond market.

The Bottom Line

The new GASB accounting rules are designed to increase transparency for bondholders and the general public, but a change in perception could have a real impact on the municipal bond market. Higher healthcare-related liabilities on the balance sheet and lower reported income could reduce the attractiveness of certain muni bond issues, which could lower prices and increase yields due to the higher perceived risk factors.

Learn about different ways to invest in muni bonds.