The municipal bond market is commonly used by high-net worth individuals in the U.S. for their tax-exempt interest payments, but taxable muni bonds have become increasingly popular around the world.

In Europe and Japan, negative interest rates have led many investors to look to the U.S. for positive yields. The muni bond market is particularly attractive since they offer higher yields than treasuries without as much risk as corporate bonds.

In this article, we will look at the impact that European and Japanese investors have had on the municipal bond market and some considerations for investors.

Rising Foreign Demand for Taxable Munis

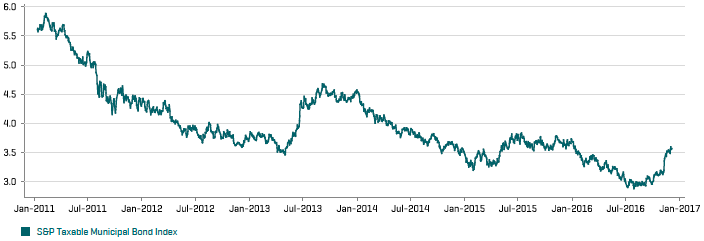

Foreign banks and pension funds are increasing their investments in U.S. muni bonds, given the negative interest rates in their own countries. Since foreigners don’t benefit from the income tax exemption, these investors have focused largely on higher-yielding taxable munis. Consider this – the S&P Taxable Muni Bond Index has a yield to maturity of 3.9%, as of Nov. 30, compared to 0.37% for 10-year German bonds and 0.04% for 10-year Japanese bonds. Be sure to read on the basics of muni bonds here.

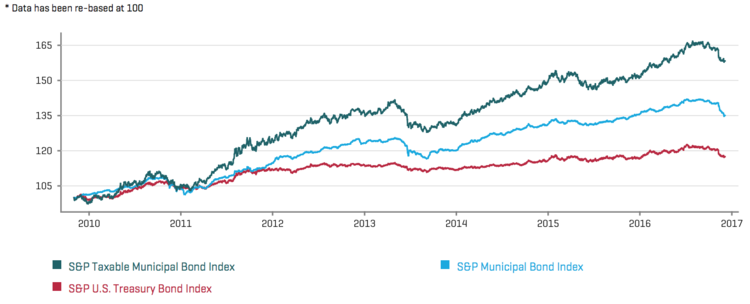

In addition to these attractive yields, taxable munis have outperformed other bonds over the past three-, five- and ten-year timeframes, as can be seen in the price chart below. The capital gains on these bonds may be limited by rising U.S. interest rates – which will have a negative impact on bond prices across the board – but they are likely to continue outperforming other types of bonds, given the strong demand for bonds that offset interest rate pressure.

Most muni bonds are held by individual investors that tend to hold them until maturity, which translates to less volatility than other asset classes that are more actively traded. If an economic downturn were to occur, the prices of these bonds are likely to remain more stable than equities or corporate bonds. You can explore the various muni bond terminologies to familiarize with the market.

Meanwhile, Build America Bonds (BABs) have become increasingly popular investments given their above-market yields. For example, the Illinois State Taxable Series 1 Build America Bond (452152BM2) offers an attractive 6.3% coupon and a relatively low likelihood of a default compared to corporate bonds. When incorporated into diversified portfolios, BABs provide a powerful way to increase yields well beyond European or Japanese fixed-income securities.

Several foreign investors in the muni market have been attracted to larger issuers, like California and Illinois, that have deep liquidity. Some sectors have also seen heightened interest, such as infrastructure through BABs, and newly minted green bonds that could offer additional incentives to foreign investors. For instance, California’s 2010 BAB sales had purchasers from 16 different countries that included sovereign wealth funds and international bond funds.

Potential Impact on the Market

The foreign interest in taxable munis has had a significant impact on the market that will likely continue if foreign yields remain near zero.

The most obvious impact of increased foreign investment has been rising prices and decreasing yields, which can be seen in the graphs presented above and below (show yield to worst), respectively. With yields near their lowest levels in a half century, U.S. investors may find it difficult to build income into their portfolios. Artificially high prices could also eventually fall and create the potential for capital losses if investors were to sell before the maturity date.

In addition to the impact on prices and yields, the involvement of foreign institutional investors could introduce volatility to the market. Many individual investors in the U.S. prefer to hold muni bonds to maturity, but institutional investors tend to actively trade when necessary to reduce risk or adjust portfolio allocations. This volatility could lead to concern among individual investors, particularly when they’re looking to buy muni bonds.

Finally, the taxable muni bond market has become a seller’s market where issuers are making fewer assurances to investors. For example, the Illinois Presence Health Network Bond (45204EFD5) offers fewer contractual guarantees than bondholders typically require given the increase in foreign demand. This means that individual investors may end up taking greater risk than they have in the past for the same yields, resulting in losses down the road.

Be sure to check our Market Activity section to check out the latest muni bond trades.

Bottom Line

The municipal bond market has been a mainstay for individual U.S. investors looking for income, but foreign investors in low-yielding markets have turned to taxable munis to bolster their portfolios, as well. These dynamics have led to higher prices and lower yields, along with the possibility of greater volatility and default risk from fewer guarantees. Muni bondholders should consider these risks, along with underlying credit quality, yield movements and the issuer’s financial condition before buying and selling these bonds.

Keep up to date on the various muni bond investment strategies to make the right investment decision.