The anticipated reduction of interest rates by the Federal Reserve, initially projected at the outset of the calendar year 2024, is now facing diminished likelihood due to the persistent presence of inflationary pressures.

Despite a notable decline from the 7% range observed in 2021 and 2022, inflation has not receded to a level in 2024 conducive to the initiation of interest rate reduction deliberations by the Federal Government. According to a recent statement by Federal Reserve Chair Jerome Powell, "The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence.”

In this article, we will discuss the ramifications of elevated interest rates and inflation on local governments, particularly regarding their inclination toward municipal debt issuances.

The Future of Rate Cuts

The outlook on the number of interest rate cuts by the Federal Reserve in 2024 has undergone shifts, reflecting changes in market conditions and persistent inflation. Increasingly, economists are leaning towards the expectation of two (or fewer) rate cuts this year, while others speculate that there may be no rate cuts at all, with the Federal Reserve potentially postponing any adjustments until 2025. Managing interest rates is a delicate balancing act for the Federal Reserve, as premature cuts could jeopardize previous economic gains, while delaying cuts may impact various sectors of the economy.

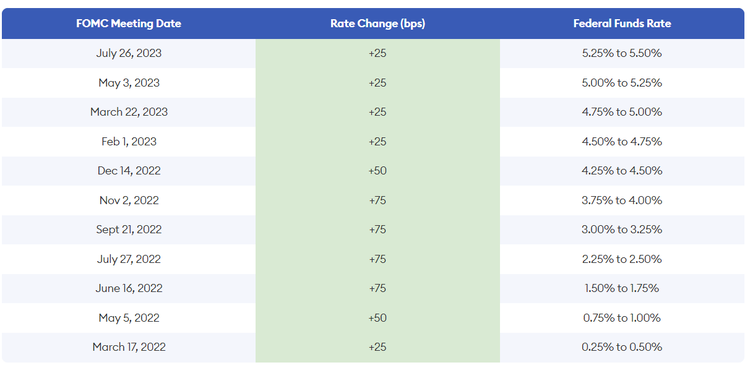

Understanding the Federal Reserve’s swift increase in interest rates is crucial for preventing the economy from overheating, as the effects of rate hikes do not manifest immediately. The chart below illustrates how interest rates hovered near 0% in the first quarter of 2022, with substantial and rapid increases occurring throughout the year. It is plausible to suggest that the influx of COVID-19 relief funds played a significant role in driving inflation above the 7% threshold, prompting the Fed’s decision to raise rates.

Source: Forbes

Interest rates play a significant role in debt markets, influencing various aspects of borrowing and lending as mentioned below.

Borrowing Costs

Changes in interest rates directly affect the cost of borrowing for both governments and corporations. When interest rates rise, borrowing becomes more expensive, leading to higher interest payments on existing debt and increased costs for new borrowing. Conversely, falling interest rates reduce borrowing costs, making it cheaper for entities to finance their operations and projects. For local governments, with fixed revenue sources, higher interest rates may limit their ability to raise enough capital to finance capital projects or delay them until the rates come down. Furthermore, there are fewer refunding opportunities for existing debt of local governments to lower their debt service cost.

Bond Prices

Interest rates and bond prices have an inverse relationship. When interest rates rise, the value of existing bonds decreases because their fixed interest payments become less attractive compared to newly issued bonds with higher yields. Conversely, falling interest rates lead to higher bond prices as investors are willing to pay more for the relatively higher fixed income provided by existing bonds. This is also true for most local governments and their fixed income portfolios – depending on their specific cash needs, some may have to prematurely sell their debt holding, which may force them to realize their unrealized losses.

Investor Demand

Interest rates influence investor demand for different types of debt securities. Rising interest rates may attract investors seeking higher yields, while falling interest rates may drive investors towards safer, lower-yielding assets. Changes in investor demand can impact the pricing and liquidity of debt securities in the market.

Credit Conditions

Interest rates affect credit conditions in the economy. From an investor perspective, elevated interest rates result in increased borrowing costs across various financial products, ranging from mortgages to credit cards. This environment typically promotes saving over spending, theoretically contributing to a reduction in prices. However, the impact of these measures is not immediately apparent, as is seen in the current market conditions, and there’s a risk that if the central bank raises rates excessively, it may inadvertently slow down the economy, potentially leading to a contraction in demand, and even a recession. The Federal Reserve is being overly cautious due to the aforementioned, as their interest rate policies are to manage credit conditions and support economic objectives such as price stability and full employment.

For small- to mid-sized cities, higher debt service costs may lead to certain budget constraints, and divert funds from other service priorities like public safety.

The Bottom Line

Overall, interest rates have a profound impact on debt markets, affecting borrowing costs, bond prices, investor behavior, credit conditions, and currency exchange rates. Effective monetary and fiscal policies are essential for managing inflationary pressures and maintaining economic stability. Also, understanding the dynamics of interest rates is crucial for participants in debt markets to make informed investment and risk management decisions.