The relationship between different securities has always been central to financial analysis. After all, most of any financial security’s value is relative rather than absolute in nature.

Municipal bond investors can analyze these relationships by looking at the spread between various bonds, factoring in any relevant market information and comparing them to historical spreads. The spread may also be expressed as a ratio to generate a number that’s easy to use in comparisons.

In this article, we will look at three different kinds of spreads and how they can be used to identify potentially profitable trading opportunities in the muni bond market.

Be sure to check out our take on municipal bond due diligence here.

Muni Market Spreads

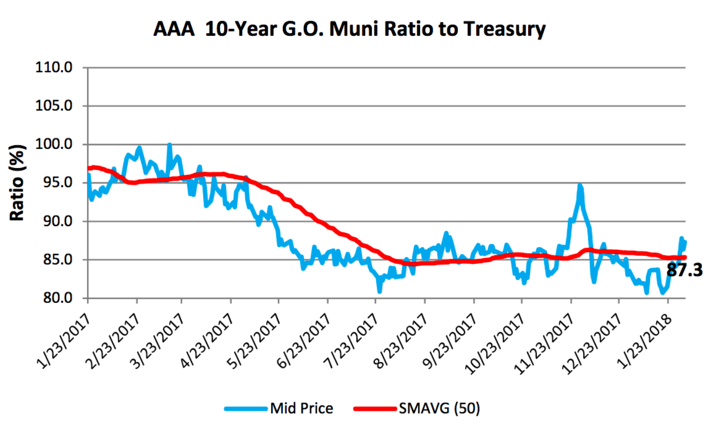

The spread between municipal bond yields and the risk-free rate – or Treasury bond yields – can help traders determine when the market is cheap or rich. Muni bonds are cheap when trading at a yield that’s relatively high compared to the Treasury yields and rich when they are trading at a relatively low percentage of Treasury yields. Traders seeking the best opportunities should buy when the market is cheap and sell when the market is rich.

For example, the figure above shows the ratio of 10-year general obligation muni bond yields to Treasury bond yields over time. The data shows that the muni bond market was relatively cheap in early 2017 and became richer toward the middle of the year. More recently, muni bond yields have started to rise and muni ratios have become slightly cheaper at 87.3 compared to the expensive 80 and 81 levels earlier in the year.

You can access our Market Activity Section to explore recent muni bond trades.

Muni Sector Spreads

Sector spreads provide further insights by comparing various types of municipal bonds. Often, traders will use a benchmark curve, such as AAA-rated muni bonds, and use it to quantify the relative risk of various sectors. The Bond Market Association produces a daily benchmark of AAA-related tax-exempt insured revenue bonds that can be used as a benchmark that is not impacted by any state-specific tax.

Traders might also compare specific sub-sectors that may be related in order to isolate and quantify specific risk factors. For example, traders may compare BBB-rated revenue bonds focused on transportation and utilities with BBB-rated hospital bonds and look at how the spread relationship is changing. Upcoming legislation, such as healthcare law changes or variations in new bond supply, could cause these ratios to change over time.

While you are on it, you might also want to check out how to capitalize on muni bond mispricings.

Muni Credit Spreads

Credit spreads provide insight into the premiums and discounts attached to a specific level of credit risk within a particular sub-sector. For example, traders might compare AAA-rated insured hospital bonds against BBB-rated hospital bonds. If the spread is typically around 100 basis points and it narrows to just 50 basis points, it may be an opportunity to re-assess the relative value of one credit to the other.

Many issuers in the primary market also watch these credit spreads to see if they should sell bonds with or without credit enhancements. If the cost of insurance is less than the spread between an insured and a BBB-rated uninsured muni bond, then there is a more compelling reason to issue new bonds with insurance. Muni bond investors may also want to consider these dynamics when evaluating new issues that come onto the market.

Check out our take on investing in muni bonds based on special provisions.

The Bottom Line

Spreads between municipal bonds and related securities can provide muni investors with a lot of actionable information. When used in conjunction with yield curve analysis, investors can use market spreads, sector spreads and credit spreads to identify potentially undervalued or overvalued bond issues and make optimal investment decisions. But, it’s important to remember to use these strategies as just one part of a broader analysis framework.

For more information, check out different ways to invest in muni bonds.