BlackRock, one of the largest muni bond managers, recently released their update on muni bond market performance for the month of July.It offers a nuanced view that combines optimism about the current strong performance with caution regarding the near future. The firm provides clear insights into strategic investment, highlighting both opportunities and potential risks, all while considering recent shifts in the credit landscape. Their guidance seems aimed at navigating the complexities of the market while recognizing the underlying stability of municipal bonds, particularly in comparison to the federal fiscal landscape.

The July update on municipal bonds paints a picture of strong performance with a warning of caution due to rich valuations and waning seasonal trends. The update emphasizes that municipal bonds maintained their seasonal strength, extending gains for the second consecutive month, driven by favorable supply-and-demand dynamics. Interest rates rose as the Federal Reserve resumed its tightening cycle, leading to a return of 0.25% for the S&P Municipal Bond Index, and a year-to-date total return of 2.78%. The performance of Triple-B rated credits and the 15-year part of the yield curve was particularly strong.

Issuance for July totaled $27 billion, down 17% from the five-year average, while the year-to-date total reached $198 billion, a decrease of 12% compared to the previous year. The reinvestment income outpacing issuance created a net-negative supply environment, resulting in deals being oversubscribed by 5.2 times on average. However, the report also advises a more cautious approach in the near term, suggesting that performance may soften in August, although prolonged weakness could present opportunities to lock in attractive yields.

BlackRock’s strategic insights include maintaining a neutral-duration posture, preferring an up-in-quality bias, and being selective in non-investment grade. The firm strongly advocates for a barbell yield curve strategy with an emphasis on the 15-20-year part of the curve. They recommend being overweight in essential-service revenue bonds, high-quality state and local issuers, flagship universities, and select issuers in the high-yield space. Conversely, they suggest being underweight in speculative projects, senior living and long-term care facilities, lower-rated private universities, and stand-alone and rural health providers.

A significant development in credit headlines was Fitch’s downgrade of the United States from AAA to AA+, reflecting concerns about fiscal deterioration, growing debt burden, and erosion of governance. This move is expected to cause a reaction similar to the municipal market response in 2011, following S&P’s downgrade, where most bonds were unaffected. Some municipal bonds linked to the U.S. Treasury may face negative rating actions, but entities with significant own-source revenue are likely to retain their ratings.

In contrast to the federal government, U.S. states are portrayed as being in a more robust position to manage declining revenues. Factors such as rainy day funds, balanced budget requirements, and low debt service levels contribute to this strength. Despite concerns regarding U.S. credit strength, states and local governments are expected to remain among the highest-rated bonds in the fixed-income asset class.

Municipal Bond Strategy Scorecard

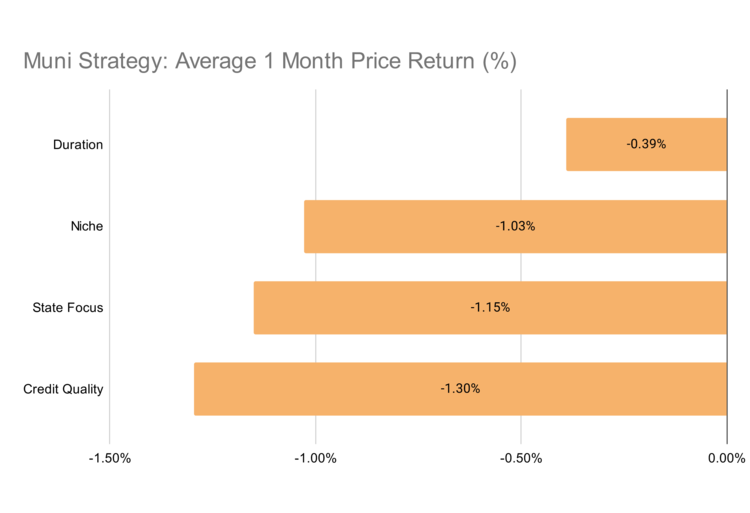

Overall, short to intermmediate term strategies outperformed several longer term strategies in the trailing one month.

Duration Strategies

Short to intermmediate duration muni strategies continue to perform better than long duration strategies over the trailing one month.

Winning

- iShares iBonds Dec 2023 Term Muni Bond ETF (IBML) , up 0.08%

- abrdn Ultra Short Municipal Income Fund INST (ATOIX) , flat 0%

- DFA Short-Term Municipal Bond Portfolio Institutional (DFSMX) , flat 0%

Losing

- VanEck Long Muni ETF (MLN) , down -2.05%

- Parametric TABS Intermediate-Term Municipal Bond Fund A (EITAX) , down -1.75%

- iShares Municipal Bond Index Fund Investor A (BIDAX) , down -1.27%

Niche Strategies

Among niche strategies, ESG focused strategy managed to outperform other niche strategies like AMT-free.

Winning

- VanEck HIP Sustainable Muni ETF (SMI) , flat 0%

- AB Municipal Bond Inflation Strategy C (AUNCX) , flat 0%

- BlackRock Strategic Municipal Opportunities Fund Institutional (MAMTX) , down -0.39%

Losing

- Pioneer AMT-Free Municipal Fund A (PBMFX) , down -2.23%

- Nuveen Municipal Value Fund Inc. (NUV) , down -2.18%

- Eaton Vance AMT-Free Municipal Income Fund I (EVMBX) , down -1.69%

State Focus Strategies

California and New York muni strategies emerged as winners in the trailing one month, while Hawaiian muni strategies lost ground.

Winning

- DFA California Municipal Real Return Portfolio Institutional (DCARX) , up 0.09%

- DFA NY Municipal Bond Portfolio Institutional (DNYMX) , down -0.1%

- DFA MN Municipal Bond Portfolio Institutional (DMNBX) , down -0.21%

Losing

- Lee Financial Hawaii Municipal Fund Investor (SURFX) , down -4.01%

- AllianceBernstein National Municipal Income Fund Inc. (AFB) , down -3.08%

- Nuveen California AMT-Free Quality Municipal Income Fund (NKX) , down -3.04%

Credit Quality Strategies

High-yield muni strategies held on to their ground while taxable strategies struggled over the trailing month.

Winning

- VanEck High Yield Muni ETF (HYD) , flat 0%

- DFA Municipal Real Return Portfolio Institutional (DMREX) , flat 0%

- Fidelity Flex Conservative Municipal Income Fund (FUEMX) , down -0.1%

Losing

- Dupree Taxable Municipal Bond Series (DUTMX) , down -3.58%

- Invesco Taxable Municipal Bond ETF (BAB) , down -3.05%

- Eaton Vance Municipal Income Trust (EVN) , down -2.99%

Methodology

Every month, we provide a snapshot of the performance of key muni bond focused mutual funds and ETFs to highlight the trending investment strategies across different segments of the broader muni market. We scan through hundreds of relevant muni bond focused mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on change in NAV.

Here is a summary of different muni bond strategies covered in this article:

- State focus strategies typically focus on muni bonds issued within specific states like New York or California. They can also include muni national bonds, which can be issued by multiple states and local governments to fund public projects.

- Credit quality strategies focus on muni bonds either carrying a specific credit rating or a range of credit ratings from investment-grade to below-investment-grade, as determined by credit rating agencies like S&P, Moody’s and Fitch, among others.

- Duration strategies focus on muni bonds, which can be assessed based on interest rate risk. Duration is typically measured in years. As a general rule of thumb, higher the duration (aka the more you have to wait to get your coupons and principal), the more will be the drop in the bond’s price as interest rate rises. This strategy can cover a wide range of muni bonds, based on short to long time to maturity.

- Niche strategies focus on any strategy that are not covered in the previous 3 categories. Some popular muni stratgies include ESG, AMT-free, risk-managed and other tactical themes meant to capture unique opportunities.