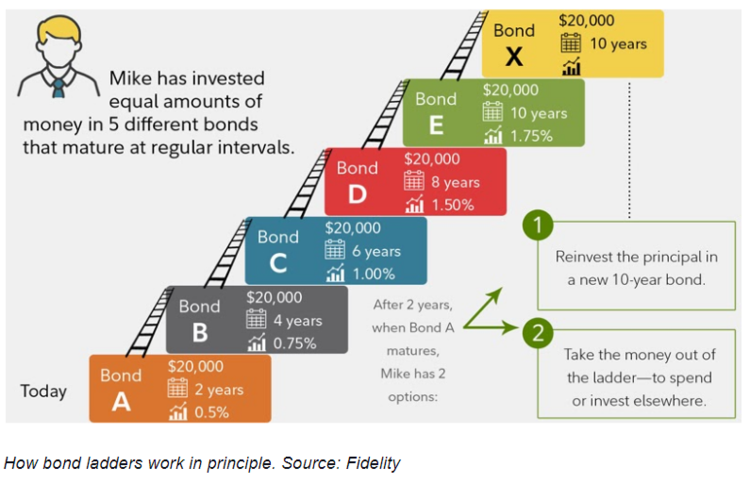

Municipal bond ladders are a common strategy to mitigate interest rate risk. If interest rates rise, you can reinvest bonds coming due in higher-yielding bonds. If interest rates fall, you always have a good number of bonds locked in at higher rates. The problem is that the current environment introduces a lot of uncertainties.

Let’s look at why muni bond investors face a challenging reinvestment environment and alternative strategies to consider.

Be sure to check out our Education section to learn more about municipal bonds.

Demand Outstrips Supply

The municipal bond market has become a fixed-income safe-haven. After a tumultuous winter, the federal government’s stimulus spending has padded state and local budgets. Meanwhile, the swift economic recovery alleviated many concerns of future budget shortfalls. These trends have eliminated the need for new muni bond issues to raise capital.

At the same time, demand for muni bonds has been on the rise. President Biden’s proposal to increase the capital gains tax rate has investors scrambling for tax-exempt investments, such as muni bonds. Falling Treasury and corporate bond yields have also led investors to search for yield in all fixed-income universe corners.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Bond Ladders Lose Luster

Many municipal bond investors use ladders to diversify risk. By holding bonds with different maturities, there’s less of a chance that interest rates will affect returns over the long term. If interest rates fall, they have locked-in higher rates. If interest rates rise, they have short-term bonds coming due and can reinvest in higher yield bonds.

The problem is that muni investors face a challenging environment to reinvest bonds coming due. With low yields, investors are potentially locking themselves in at low rates. Meanwhile, the rising threat of inflation has created a real potential for negative returns. Even Warren Buffett recently warned that fixed-income investors would suffer.

Alternative Strategies

General obligation bonds may have near-record low yields, but there are pockets of opportunity in the municipal bond market. So, investors may want to consider directly investing in these bonds or seeking out actively managed funds that take advantage of them, rather than investing solely in market-cap-weighted or laddered bonds portfolios and funds.

Some opportunities include:

- BBB-Rated Bonds: BBB-rated muni bonds may offer investors higher yields if they fall into higher tax brackets. Low-rated muni bonds have also defaulted less than low-rated corporate bonds, making them a potentially safer source of income. Illinois and New Jersey are the two biggest issuers of BBB-rated bonds.

- Revenue Bonds: The imminent passage of the infrastructure bill could create revenue bond opportunities across the U.S., including roads, bridges and rail lines. Meanwhile, healthcare, small university and student housing sectors may see improvements as vaccines roll out across the nation.

If you’re using exchange-traded funds (ETFs), actively managed funds may provide better risk-adjusted returns than passively managed funds using bond ladders. However, before investing, you should carefully consider the expense ratios and other fees, and keep in mind that actively managed funds have historically underperformed passively managed funds.

Some active or smart-beta funds to consider include:

- *Columbia Multi-Sector Municipal Income ETF * (MUST)

- PIMCO Intermediate Municipal Bond Strategy Fund (MUNI)

- PIMCO Short Term Municipal Bond Fund (SMMU)

- American Century Diversified Municipal Bond ETF (TAXF)

- IQ MacKay Municipal Intermediate ETF (MMIT)

Be sure to check our Active ETFs Channel to learn more.

Potential Risks

There are a few risks that could impact the municipal bond market over the coming year or two. Investors should keep these potential risks in mind when building out their portfolios.

Proposals aiming to cap the benefit of holding tax-exempt securities at 28% could lead to a rise in tax-exempt yields relative to other assets since the after-tax benefit of holding munis would decrease. But, of course, the corollary of rising yields would be a fall in prices, hurting muni bondholders and a wide range of muni bond funds.

As part of the Tax Cut and Jobs Act, the benefit of state and local tax deductions was capped at $10,000. The move compressed credit spreads, particularly in high tax states like California and New York. The potential removal of the State and Local Tax (SALT) cap could put pressure on credit spreads in these states if it materializes down the road.

The Bottom Line

Municipal bond ladders are an excellent way to mitigate long-term interest rate risk, but in the current environment, they could prove risky. As a result, investors may want to consider reinvesting bonds coming due to alternative strategies that could offer better risk-adjusted returns while keeping in mind their potential risks.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.