Municipal bonds are an important fixed income asset class for investors seeking above-market tax-advantaged yields. Muni bonds offer a safe and high-yielding asset class during low interest rate environments, as well as an attractive tax-advantaged asset class during rising interest rate periods. These attributes have helped the market surpass $3 trillion in size, making it one of the largest and most stable markets in the world.

In this article, we will take a look at some free resources that investors can use to remain up to date with credit events, support independent credit analysis and find investment opportunities in the U.S. muni market.

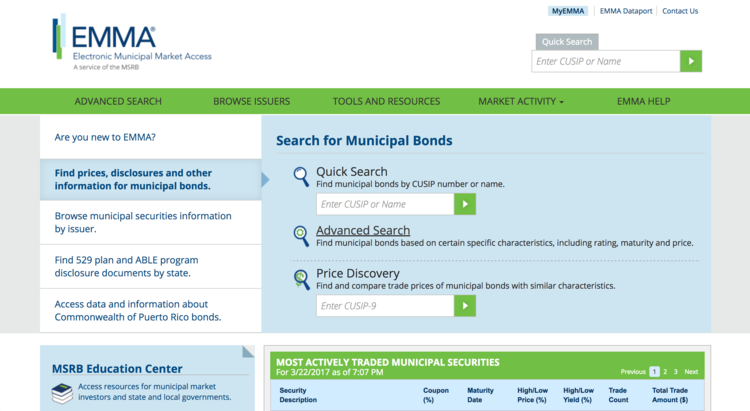

1. MSRB’s EMMA

The Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access (EMMA) is the authentic free resource for municipal bondholders as mandated by regulatory bodies. Investors can use the website to browse issuers, find bond prices, read disclosures and see recent trades, as well as access credit ratings across various agencies. In addition, investors can access helpful tools like an economic calendar, new muni issues calendar and muni price discovery tool.

Check out our municipal market glossary to familiarize yourself with various terminologies.

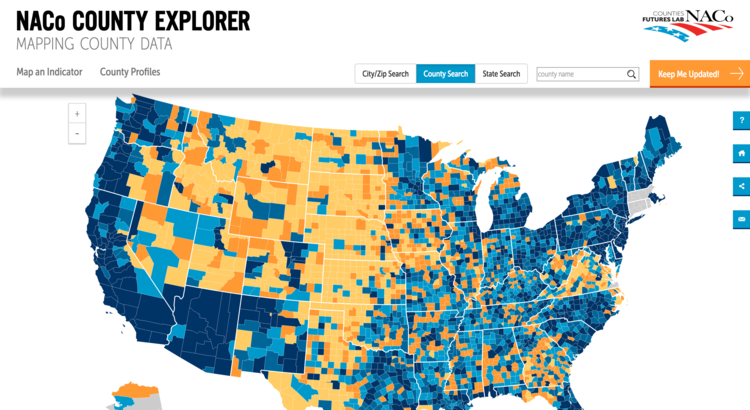

2. National Association of Counties

The National Association of Counties’ (NACO) Futures Lab is an invaluable tool for municipal bondholders who want to analyze a municipality’s economic health and prospects. In particular, the Economic Profile provides a helpful one-pager that enables investors to analyze a county and its economic vitality, including insights into employment, home prices and industrial concentrations that can affect a municipality’s credit quality.

Be sure to check key economic indicators for the muni market that you should be aware of.

3. New York Times

The New York Times’ Municipal Bonds Section provides insights into the latest muni bond issues hitting the market, which might interest primary market investors. In these updates, the leading news agency provides a list of the latest pricings in the market, as well as whether they are competitive in terms of price and yield. This can be a helpful starting point for investors seeking specific opportunities in the market.

4. FMS Bonds

FMS Bonds is a leading municipal bond firm that provides both transactional services and real-time information for investors in the market. In addition to its timely news and insights, the company provides a question and answer forum for individuals to ask experts anything, tools for investors to analyze their own portfolios, and other free resources for investors to identify, analyze and execute their investment decisions.

5. CNBC

CNBC has become a leading financial news network over the past several years. In its Municipal Bond section, investors can find a wealth of real-time news and insights into market conditions, credit events and broader muni bond market trends.

6. Council of Development Finance Agencies

The Council of Development Finance Agencies (CDFA) is a national association dedicated to development finance concerns and interests. By searching for infrastructure finance terms, investors can find valuable information covering new municipal projects and financing

7. BondView

BondView is a leading provider of municipal bond insights and tools for investors. In addition to a library of educational content, the website provides numerous tools designed to help investors identify investment opportunities and analyze their existing holdings. It provides a limited set of free and premium tools that allow investors to grade their portfolios by relevant metrics.

8. The Hill

The Hill is a leading resource for political news and information, which can have a significant impact on municipal bond markets. For example, politicians may decide to raise taxes, which could increase a municipality’s credit quality, or perhaps succumb to populism and refuse to repay bonds, as occurred in Puerto Rico. The website provides less timely updates than CNBC and other sources, but provides a lot more detail in some cases.

9. Muni Credit News

Muni Credit News is a free resource for news and information that covers the municipal bond markets. As a dedicated resource created by Joseph Krist, an analyst with five decades of experience in the muni market, the website provides a lot more in-depth information in its blog compared to generic news resources. It also offers portfolio analysis and reviews for a premium to professional and individual investors in the space.

10. The GMS Group

The GMS Group is a municipal securities dealer with industry-recognized experts focused on helping high-net-worth individuals. In addition to its brokerage services, the company provides a wealth of free educational resources for investors interested in the space, including a video gallery, weekly review/preview, real-time news and sample portfolios.

The Bottom Line

Municipal bond investors might want to check out these free resources when looking for opportunities in the market.

In addition to these resources, investors can use relevant tools on MunicipalBonds.com, including the Market Activity section to view recent trades, and relevant content in the form of weekly market news and investor education segments. By becoming a premium member, you can also get immediate access to all the latest Moody’s credit reports for municipal bonds across the U.S. and enhance your analysis for a specific security