Most investors are familiar with interest rates, but it’s important to look beyond the headline rate. By looking at yield curves, investors gain better insights into market sentiment. Normal yield curves suggest a healthy market, but steep yield curves indicate the start of economic expansion and inverted yield curves can be a sign of trouble.

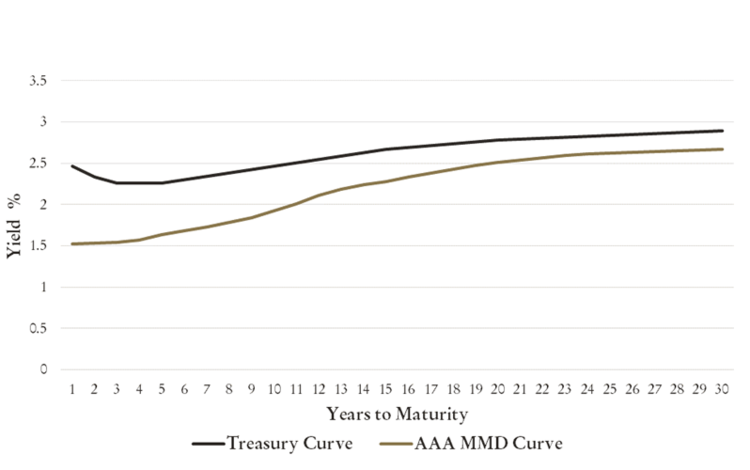

Treasury yield curves are often referred to as the “benchmark curve” since they are backed by the U.S. government. Investors often compare other debt instruments to these benchmarks and calculate “spreads” between them. The spread is an important indicator of market sentiment on its own. Although municipal bonds should theoretically have no spread, that’s not always the case.

Let’s look at the difference between Treasury and municipal bond yield curves, and what investors need to know.

Click here to learn more about yield curve inversion risk.

Treasury vs. Muni Differences

Treasury bonds are backed by the full faith and credit of the U.S. government. By comparison, municipal bonds are typically backed by the full faith and credit of individual state or local governments. The difference, or spread, between Treasury and muni bond yields often reflects the credit and liquidity risk premium that investors are assigning to municipalities.

But, recent examples suggest there may be more to the story.

The Treasury yield curve inverted in 2018/2019, whereas the muni bond yield curve resisted inversion. The 10-year AAA General Obligation Muni Ratio reached its lowest levels since 2001 during this period, suggesting that there are other factors at play. Investors should understand these differences to best position their portfolios.

Use our Screener to find the right municipal bonds for your portfolio.

Some of these other factors include:

- Supply and Demand: The potential for higher long-term interest rates could lead investors to move into short-term bonds, which anchors short-term yields and bolsters long-term yields (due to less demand).

- Tax Law Changes: The changes in tax legislation could lead banks, insurance agencies and other large muni holds to liquidate their longer-term bonds, which could put greater pressure on yields for those maturities.

- Interest Rates: The rising interest rate environment led to outflows at several ETFs and mutual funds, leading to a reduced demand for muni issues.

- Other Factors: Long-term tax expectations can influence the muni curve given the tax advantages that the bonds enjoy. Muni bonds also have optionality at 10+ year maturities, which can influence the long end of the muni curve.

Many of these factors tend to arise when there is significant uncertainty in the market. For example, the 2013 Taper Tantrum, 2016 Presidential Election and Tax Reform all led to volatility-induced selling in the muni bond market and widening spreads with Treasury bonds.

Implications for Investors

The difference between Treasury and municipal bond yields is important for a few different reasons.

First, greater spreads between Treasury and muni yield curves could translate to opportunities in the muni market. If these spreads were caused by a supply and demand imbalance due to volatility, patient investors may benefit from buying into the volatility and waiting for spreads to normalize. This is assuming that the spreads are only due to volatility.

Second, the muni curve may not be as helpful as the Treasury curve when assessing market sentiment. Since it’s influenced by taxes, optionality and other built-in factors, the muni curve doesn’t reflect purely the expectations of future interest rates. This means that investors looking for market sentiment indicators should stick to observing movements in Treasury yield curves.

And, finally, the spread between the Treasury and muni yield curves can still be helpful when assessing credit risk. While other factors play a role, researchers have found that credit and liquidity risk can account for almost all of the difference between the two yield curves. This is especially true when looking at non-AAA GO bond issues.

Don’t forget to check this article to learn about the impact of the yield curve on muni debt valuation.

The Bottom Line

Yield curves can provide a lot of insights into market sentiment. The difference between Treasury and municipal bond yield curves can be perplexing, but most of the differences can be attributed to a handful of factors. Understanding these differences can be extremely helpful for investors for a variety of reasons.

Be sure to check out our Education section to learn more about municipal bonds. And sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.