The process of registering, issuing and selling municipal bonds is a complicated endeavor that investors should understand in detail before purchasing newly issued bonds.

In particular, it’s important to understand how all participants in the process are compensated to fully understand the risks involved and to assist in proper due diligence. This can help you avoid purchasing mispriced bonds.

In this article, we will take a look at underwriter spreads and how they affect the returns of individual muni bond investors.

The Role of Underwriters in the Bond Issuance Process

The process of registering and selling municipal bonds is complicated, which is why underwriters are usually hired to assist state and local governments.

The process begins when a state or local government decides to issue a bond. To assist in the process, they hire a financing team to develop the offering documents, engage any ratings agencies, create investor presentations, market the bond offering to investors, price the bonds and close the transaction. This process involves different parties including municipal advisors, bond counsel, underwriters, ratings agencies, trustees and others.

The initial offering price is the price of the bond offered to the public at the time of original issuance. Muni bonds are normally sold based on the yield of the transaction, but they may also be offered at a set premium or discount to par value. For example, a normal muni bond’s yield might be equal to the stated interest rate on the bond, while a muni bond priced at a discount to par value will have a yield higher than the coupon rate.

The gross underwriting spread is the difference between the price paid by investors and the amount paid by an underwriter to the issuer for the securities. For example, if an issuer sells $5 million in muni bonds to investors at par value with a 1% underwriting spread, then the issuer would receive $4,950,000 and the underwriter would receive $50,000 as compensation for distributing the newly issued securities to investors and undertaking the risks of marketing the bonds.

The underwriting spread is not standardized and varies significantly across dealers. The same bond might trade at significantly different levels depending on the dealers and investors involved in the transactions. Fortunately, tools like EMMA (offered by the Municipal Securities Rulemaking Board) can help determine the extent of markups in past transactions while making sure that municipal specialists don’t charge exorbitant commissions on trades or mark-ups.

For more information, see The Basics of Municipal Bonds and How They Work.

Challenges and Opportunities for Underwriters

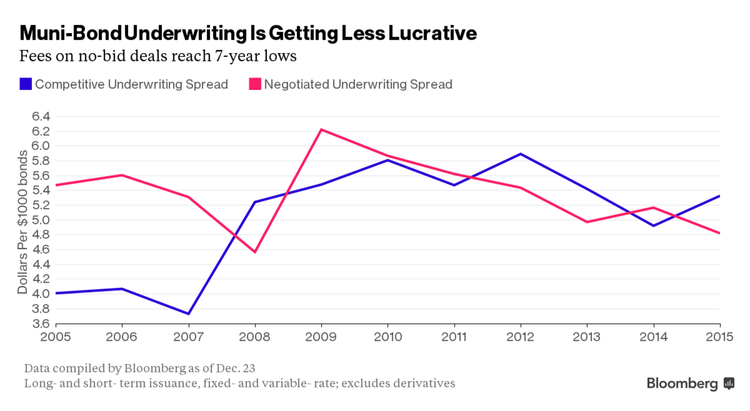

Municipal bonds have been growing in popularity, but underwriting bond issues have become less profitable. According to Bloomberg, fees on negotiated deals – which comprise three-quarters of the market – fell to $4.80 per $1,000 of bonds in late-2015, the lowest levels since 2008. Negotiated deals entail state or local governments selecting a bank in advance rather than simply offering the bonds to the lowest bidder in an auction.

Competitive deals have their own share of problems as well. Aside from bonds sold in a pre-sale, the underwriters of a competitive deal must commit to underwrite the entire amount and take on more risk. Negotiated deals involve the bond going through an order period with only a small balance being assumed as risk. Tight spreads have made competitive deals more risky, given the lack of income and high amount of resale risk.

For more information, see the Glossary of Muni Bond Terms to familiarize yourself with terms like negotiated deals.

The primary cause of lower underwriting spreads has been low interest rates, which has increased competition as banks search for yield. Declining trading volume in muni bond issues also means that banks have been forced to underwrite bonds to offer them to customers, further increasing competition. And finally, new regulations put in place since 2008 have made underwriting more expensive and less profitable for banks.

The largest muni bond underwriters include companies like Bank of America Merrill Lynch and Citigroup. With the reduced profitability, some banks have decided to exit the market or sell their businesses. Guggenheim Securities, Bank of Montreal and Sterne Agee Group are just a few financial services firms that sold off their local government bond businesses back in 2015, following the lack of profitability.

On the other hand, companies like UBS Wealth Management Americas is looking to revive their muni bond businesses. The firm had previously exited the business following the financial crisis, but decided to re-enter the business amid the rising interest rate environment. With the Federal Reserve expected to hike rates further this year, investors could refocus on double and triple tax-exempt securities – like muni bonds – as a critical asset class.

Aside from these large underwriters, there are many smaller underwriters that, in aggregate, comprise the majority of the industry.

Underwriting Spreads & Investors

Municipal bond underwriting spreads have a significant impact on investors since they effectively determine the pricing of the offering.

- Low underwriting spreads may encourage these banks to take on greater risks, such as lower quality debt or complicated debt structures, to increase their yields.

- In other cases, underwriters may push toward more competitive negotiated deals that entail greater risk through full commitments.

Investors should keep these factors in mind when conducting due diligence on newly issued bonds.

This should eventually be part of an investor’s muni bond investment strategy.

The Bottom Line

The process of registering, issuing and selling municipal bonds is a complex and multi-party process. Underwriters are a key part of the process and typically earn their fees through the underwriter spread – or the difference between the price at which they purchase bonds and the price at which they sell. Investors should consider underwriter-related factors when conducting due diligence on newly issued muni bonds.

By becoming a premium member of MunicipalBonds.com, you can get immediate access to all the latest Moody’s credit reports for municipal bonds across the U.S. and embrace your analysis for a specific security.