The municipal bond market has experienced its fair share of headwinds over the past few years, including credit issues in Illinois and Puerto Rico and rising interest rates. While the economy has been improving, many municipalities have been hesitant to issue new bonds given the rising interest rates. However, demand among investors has remained robust given the favorable yields.

In this article, we will take a look at three reasons why muni bonds remain attractive to investors in 2019 as well as some lingering concerns in the market.

Credit Quality Remains Strong

The municipal bond market has experienced its fair share of shockwaves over the past decade. In 2016, Puerto Rico defaulted on constitutionally guaranteed general obligation bonds, marking the first such event since the Great Depression. Detroit’s 2013 bankruptcy also sent shockwaves through the market as the largest city to default.

Still, the vast majority of the muni bond market remains highly rated in terms of credit quality and insurer portfolios despite these isolated events. According to SIFMA’s latest Municipal Bond Credit Report, 65 percent of municipalities have AAA or AA+ ratings from Fitch and only Puerto Rico and Illinois have ratings that are below investment grade.

Use our Municipal Bond Screener to find the right municipal bonds for your portfolio.

Investment grade “Aaa” and “Aa” rated muni bonds haven’t experienced any defaults over the past 50 years—a remarkable track record over time. Out of the thousands of muni bonds issued, there were less than 100 muni bond defaults between 1970 and 2015, representing a default rate of just 0.09 percent—well below the corporate bond market.

The biggest lingering concern among investors is fiscal pressures associated with underfunded pension programs, according to the SIFMA’s 2019 Municipal Bond Issuance Survey, and that only impacts a small number of municipalities. In fact, Illinois is the only major cause for concern and its bonds ratings already reflect the risk.

Click here to learn how broad investor perception can drive the muni bond market.

Long-term Performance Is Robust

The municipal bond market has produced compelling returns over the past several decades thanks to its unique tax advantages. Since muni income is tax-exempt, high net worth investors benefit from greater after-tax returns than comparable fixed-income investments. There’s also a wide range of credit risks and yields available to investors.

The Bloomberg Barclays Municipal Total Return Index (LMBITR) has produced higher returns than the Bloomberg Barclays Aggregate Bond Total Return Index or the Bloomberg Barclays U.S. Government Total Return Index over the long-term – even before accounting for tax-related benefits that improve after-tax return for investors.

| Timeframe | Municipal Bonds | Total Bond Market | Government Bonds |

|---|---|---|---|

YTD (3/1/19) | 1.22% | -0.04% | -0.23% |

1-Year | 3.92% | 2.68% | 2.60% |

3-Year | 2.31% | 1.75% | 0.59% |

5-Year | 3.43% | 2.28% | 1.66% |

There was initially some concern that the Tax Cuts and Jobs Act would eliminate some of the tax benefits associated with muni bonds, but the final rule left exemptions in place on a federal level. Attempts by the IRS to cap exemptions on the local and state level at $10,000 are also the subject of numerous lawsuits by states.

Supply & Demand Remain Favorable

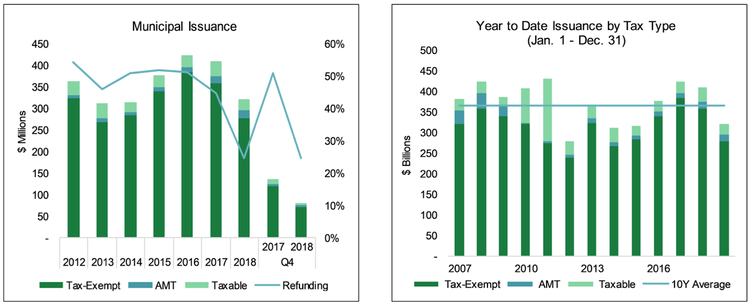

Municipal bond supply has been contracting at a time when demand remains relatively robust, especially given the rising interest rate environment.

Click here to learn more about the due diligence process for analyzing muni bonds.

Municipal bond issuance volume reached $320.2 billion in 2018, according to Refinitiv, which represents a 21.6 percent decline from 2017 and remains well below the 10-year average of $363.8 billion. Analysts believe that these issuances will continue to decline to $317 billion in 2019, according to a SIFMA survey, as interest rates continue to rise.

The Tax Cuts and Jobs Act left muni bond income tax exemptions in place at the federal level, while personal income tax brackets were only moderately adjusted. While lower corporate tax rates could make taxable bonds more attractive to some companies, most muni bonds are owned by households and funds, so the impact has been minimal.

The IRS’ new rules on so-called SALT deductions – putting a $10,000 cap on deductions for state and local income taxes – could increase muni demand from investors in high-tax brackets, but those increases may be offset by the lower tax rates for high net worth individuals and corporations — which account for much of the demand for muni bonds.

The Bottom Line

The municipal bond market remains in good shape despite several headwinds over a couple of years. With stable demand and falling supply, the market remains in good condition and should continue to be a go-to fixed income investment class.

Sign up for our free newsletter to get the latest muni bond news delivered straight to your inbox or check out our education section to learn more about muni bonds.