The equity markets may have relatively straightforward pricing, but coupon payments complicate matters in fixed-income markets.

Bonds have two different ways of quoting prices – clean or dirty – depending on whether or not accrued interest is included. The vast majority of bonds are quoted as ‘clean prices’ and transacted at ‘dirty prices,’ which means that investors should understand the difference to know what they’re paying.

In this article, we’ll take a closer look at dirty vs. clean pricing and what it means for investors who are buying and selling bonds.

What’s the Difference?

The majority of bonds – with the exception of zero-coupon bonds – make regular coupon payments to bondholders for interest that is accrued over a period of time. For example, bonds that make semiannual payments will pay out interest accrued over each six-month period. To learn more about the concept of accrued interest, click here.

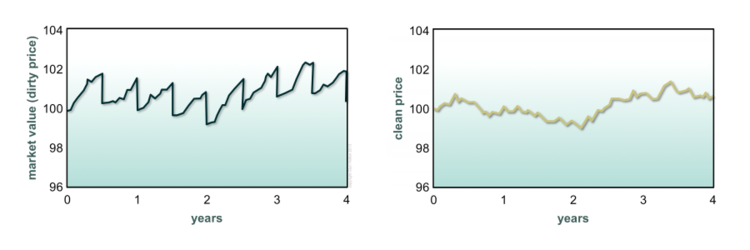

The price that a buyer pays for a bond at any given point in time should include accrued interest, since they’re acquiring the rights to the upcoming coupon payment. On the other hand, accrued interest leads to rising and falling bond prices that can make it difficult to analyze the impact of interest rates or credit quality. The removal of accrued interest from bond prices makes it easier for investors to analyze the market factors affecting valuations. This is demonstrated in the graphs (shown below) wherein dirty and clean prices behave quiet differently from the time a bond is issued till the time the bond matures. In a way, the clean price smoothens out the irregularities in the dirty price caused by the accrued interest component.

The vast majority of bond prices are quoted as ‘clean prices’ that exclude accrued interest in order to make them easier for investors to analyze. For example, the Municipal Securities Rulemaking Board (MSRB) and MunicipalBonds.com both use ‘clean prices’ to make it easier for investors to analyze market factors, influencing price. These same conventions are used in fixed income markets around the world for similar reasons.

Converting One to the Other

While bonds are usually quoted as ‘clean prices,’ they are always transacted at the so-called ‘dirty prices’ that include accrued interest. Bond buyers can calculate the ‘dirty price’ by adding the value of accrued interest to the quoted ‘clean price,’ where accrued interest is calculated using a simple interest formula. The coupon is multiplied by the number of days from the last coupon date to the settlement date divided by the total number of days between two coupon payment dates.

The calculation of the denominator depends on the convention that’s being used. With an actual/actual day count, investors simply count the days between the past and upcoming coupon dates. With the 30/360 method, investors set the denominator to 180, assuming that the coupon is paid semiannually.

When it comes to transaction, sellers keep the coupon payment if the bond trades on or after the ex-coupon date; although, the seller must pay accrued interest over the period.

Understanding These Dynamics With Two Different Types of Muni Bonds

Suppose that an investor wants to purchase a Butler County Transportation Improvement District municipal bond (click here to see CUSIP details), which offers a 3.5% coupon that’s paid out on a semiannual basis. Let’s assume that the quoted ‘clean price’ is $106 as on November 1. However, that doesn’t include the interest accrued between June and December. The investor must add back the interest in order to determine the ‘dirty price’ that would be ultimately paid.

In this case, the semiannual coupon payment would be 1.75% (3.5%/2) of $106.00, which equals out to $1.855. Assuming the 30/360 convention is used, the denominator of the equation would be 120 days to account for the four months since the last coupon payment. The accrued interest would therefore be 1.855 * (120/180) = $1.236. The ‘dirty price’ that the buyer would pay is, therefore, $106.00 + $1.236 = $107.24.

Next, let’s assume that an investor wants to purchase a Philadelphia Authority for Industrial Zero Coupon Retirement municipal bond (click here to see CUSIP details). The quoted ‘clean price’ of the zero-coupon bond is $99.25, which is also the ‘dirty price’ – since there is no accrued interest to add back. The investor can simply purchase the zero-coupon bond at the quoted price without having to worry about making any further calculations. To learn more about zero-coupon muni bonds, click here.

To explore the muni bonds issued by the states of Ohio and Pennsylvania, click here and here.

Important Considerations

Investors in the municipal bond markets should calculate and value bonds based on ‘dirty prices,’ even though they may rely on ‘clean prices’ when conducting their analyses. The difference between the two prices is the greatest when investors are buying a bond just before a coupon payment. Of course, there’s no difference between ‘dirty prices’ and ‘clean prices’ for zero-coupon bonds since they don’t have any accrued interest.

The analytical tools available on MunicipalBonds.com utilize ‘clean prices,’ since they’re superior for looking at the impact of interest rates or changes in credit risk. Investors should be sure to add back accrued interest to get an idea of the actual price they would pay for the bond before transacting. In addition, investors can explore recent trading history and CUSIP attributes of muni bonds by going to the Market Activity section of MunicipalBonds.com.

The Bottom Line

Bond prices are often quoted as ‘clean prices’ that don’t include any accrued interest in order to simplify analysis. But investors buying or selling bonds do so at ‘dirty prices’ that include the interest that accrues between any two coupon payments. Investors should understand these differences and know how to calculate ‘dirty prices’ in order to have a better understanding of how much they’re paying for a municipal bond.

For more information on municipal bond concepts and tips for investors, visit the MunicipalBonds.com Education Center. To become familiar with the key terminologies used in the context of muni bonds, click here.