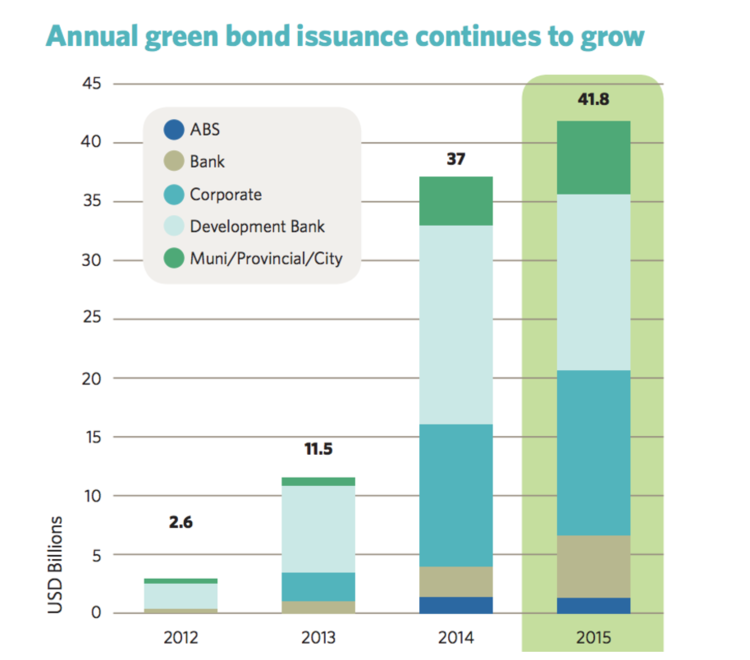

Green municipal bonds have become increasingly popular with volumes increasing from $693 million in 2013 to more than $4 billion in 2015.

Unlike traditional muni bonds that finance city or state budgets, green muni bonds support projects targeting energy efficiency, pollution prevention, sustainable agriculture, clean transportation and other environmentally friendly projects that have the potential to improve the planet.

In this article, we’ll look at why investors may want to consider green bonds, how to find opportunities and some important risks to consider.

Factors Driving Optimism in This Sector

Green muni bonds provide investors with the opportunity to promote environmentally conscious causes and generate a market return at the same time. Since the bonds are tax-exempt and offer ongoing disclosures, they provide investors with greater after-tax yields and more transparency than many alternatives. To learn more about the basic concept of green bonds, read this. Investors can also find recent green muni bond trades using our Market Activity section here.

While investors benefit from an enhanced targeting of environmental causes, the financial benefits to issuers is debatable at the moment. The strong demand for green bonds hasn’t translated to a pricing benefit to issuers – although there’s no pricing penalty. Many experts believe that these pricing benefits will start to materialize as the market matures. The good news is that issuers do benefit from increased diversification from the participation of individual investors.

Sectors Likely to Attract Green Investment

The majority of green bond investments are allocated to renewable energy (46%), with energy efficiency (20%), low carbon transport (13%) and sustainable water (9%) accounting for much of the remainder of the market, according to The Climate Bonds Initiative. Other minority sectors include waste and pollution, agriculture and forestry, and climate adaptation.

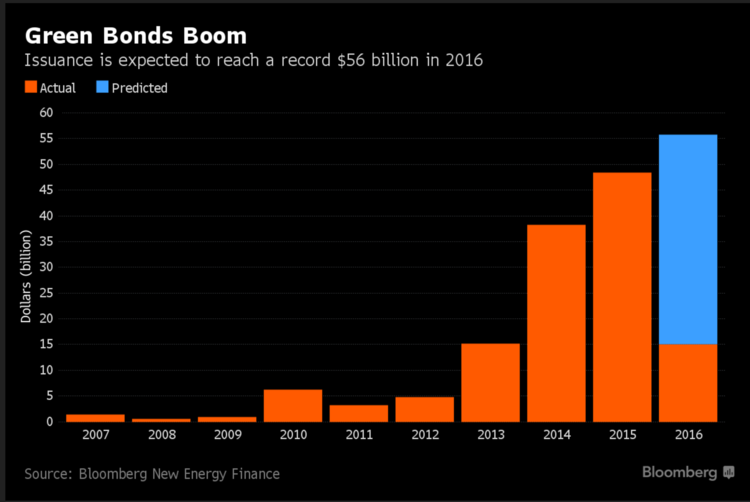

Municipal bonds have also been growing as a percentage of total green bonds, helping the U.S. market exceed supranational institutions as the largest issuer. However, municipal green bonds still account for less of the market than development bank bonds or corporate green bonds.

Prominent Green Muni Bond Issuances

Let’s take a look at a couple of green bonds and the types of projects they finance.

The Massachusetts Water Resources Authority’s (click here to get CUSIP details) green bond proceeds are used to finance the rehabilitation of water treatment plants to comply with environmental laws such as the Federal Safe Drinking Water Act. Since the bond is insured, there is also little risk for default compared to other utility bonds. To know more about other bonds from the same issuer and from Massachusetts, click here and here.

The State of California issues insured General Purpose Green Bonds’ (click here to get CUSIP details) proceeds are used for a variety of different projects targeting air pollution reduction, clean water, energy efficiency, protection of waters, flood prevention, wildlife conservation and other causes. To know more about other bonds from the same issuer and from California, click here and here.

Key Considerations for Investors

The green bond market is still relatively young compared to the wider municipal bond market, which means that growing pains remain a problem. For example, there’s no universal definition of what qualifies as a green bond, which means that investors must investigate state-specific guidelines. Some investors may also disagree with these definitions in cases, for example, when a nuclear power plant project may be considered as a ‘green’ project.

The good news is that issuers and ratings agencies are improving over time. In recent years, the major credit rating agencies have expanded their criteria for green bonds in order to help investors navigate the complex marketplace. For example, Moody’s published its Green Bonds Assessment (GBA) methodology in March of 2016 saying that it evaluates these bonds based on organization, use of proceeds, disclosure of proceeds, management of proceeds and ongoing disclosures on environmental projects financed with these funds.

Issuers are also required to provide detailed disclosures regarding the ‘green’ projects, controls for the use of proceeds and the types of municipal bonds that they’re using to finance the projects (e.g. structured vs. vanilla). Investors should look to be sure that the environmental projects being financed fit with their investment objectives, while following up with issuer updates to ensure that everything remains on track over time.

For their own piece of mind, investors should also investigate the projects that these bonds are financing and follow-up with the bonds over time to ensure they’re meeting ‘green’ goals. Many green bond issues may also offer higher risk – particularly if they aren’t insured – than general obligation (GO) bonds. To know more about GO and revenue bonds, read here.

The Bottom Line

Green bonds provide investors with a unique opportunity to invest in environmental causes for an attractive market return. While the market is still maturing and risk factors remain, issuers and credit ratings agencies have made significant progress in improving transparency and working towards universal criteria for green bonds. The expansion of the market could also help drive down costs for issuers and encourage more ‘green’ projects.

To keep up to date with the basic concepts and tips about muni bond investing, visit our Education Section here.