Municipal bond sales are expected to decline over the next month, while the amount of redemptions and maturing issues increase, according to Bloomberg data. With interest rates expected to rise in December, the issuance of muni bonds could continue to decline moving into next year, as governments adjust to a higher cost of capital. Investor appetite is likely to remain robust, however, which means prices could see an increase.

In this article, we’ll take a look at why muni bond issuances are likely to continue falling due to rising interest rates, as well as why investors still may be interested in the asset class.

Rate Sensitivity

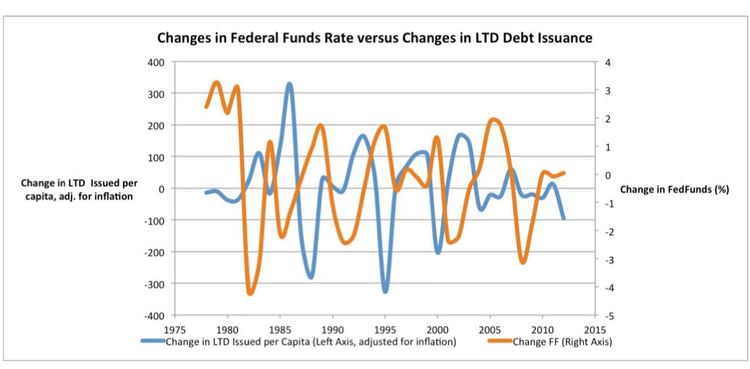

Many municipal governments tend to borrow less as interest rates rise, which means fewer municipal bonds will be issued after the rate hike. In Figure 1, there’s a clear inverse relationship between the federal funds rate and issuances of new muni bonds over time. An analysis by OpenGov found that a 1% increase in the federal funds rate resulted in a $28 decrease in long-term debt issued per capita in the United States.

On the other hand, many experts expect interest rates to remain relatively low for an extended period of time due to muted inflation expectations. Municipal projects put on hold during the economic downturn could be restarted as soon as the economic climate begins to improve, which may be happening based on the rate hike decision itself. These dynamics ultimately could offset part of the decrease in new issuances expected with a rate hike.

Flattening Yield Curve

Most bonds tend to depreciate during rising interest rate environments, since higher yields push prices lower – but municipal bonds are an exception.

Muni bonds are considered safe-haven investments, and offer attractive yields due to their tax-advantaged nature – especially for high-net-worth individuals. While short-term muni bonds may fall in price after a rate hike, long-term muni bonds could benefit from a flattening yield curve driven by low inflation expectations. These dynamics occurred during the last interest rate hike during the 2004 to 2006 timeframe.

As of November 23, municipal bond mutual funds had net inflows of $263 million, which marked their seventh consecutive week of positive flows. Investors are seeking both high yields during the current low-rate environment and a safe-haven income investing asset class during a period of rising interest rates moving forward. Of course, there’s a risk these dynamics could quickly reverse if interest rates rise faster than expected.

The Bottom Line

Municipal bond sales are expected to decline over the next month, as governments prepare for a likely interest rate hike in December. At the same time, investor appetite for muni bonds remains robust due to the bonds’ attractive tax treatment and relative safety. These dynamics could lead to an increase in prices over the coming months and potentially lower yields, especially in long-term muni bonds where the yield curve likely will flatten.