The municipal bond market is unique in many ways. Since muni bonds offer tax advantages, individual investors directly own a large number of bonds that are often held to maturity. These dynamics are different from traditional bond markets where mutual funds and other financial institutions tend to own the majority of assets.

In this article, we’ll take a closer look at these dynamics and how they influence the pricing of municipal bonds.

Looking at the Data

The Federal Reserve regularly releases a report detailing the financial accounts of the United States, which includes the breakdown of various fund flows and balance sheets.

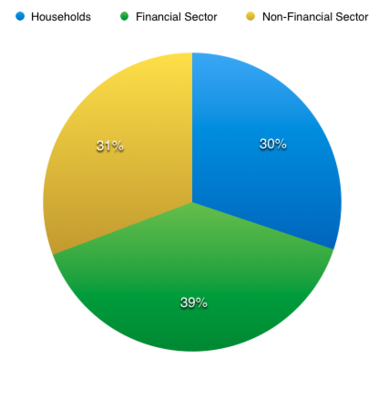

According to its Q3 2015 report, households and nonprofits own approximately $1.54 trillion worth of municipal bonds, while financial institutions own just over $2 trillion. The remainder is accounted for by nonfinancial institutions (corporate holdings) of $1.57 trillion and various smaller accounts amounting to just a few billion dollars apiece. This means that households actually account for about 30% of total muni bond holdings.

It’s worth noting that the financial sector has taken an increasingly large share of assets over the years due to the growing popularity of exchange-traded funds (ETFs). The financial sector has increased its buying of muni bonds every year since 2011, while households have reduced their direct exposure every year since 2011, with the possible exception of 2015. These trends are likely to continue moving into 2016 and beyond due to the cost savings and simplicity.

Pricing Dynamics

The price of municipal bonds is determined by buying and selling – or the latest transaction price. Often times, financial institutions only consider “block trades” when setting these prices, which include trades worth over $1 million.

Mutual funds tend to have a lot of sway over the muni bond market since they buy and sell large blocks of bonds relative to individual investors. While individual investors hold nearly a third of the market, these financial institutions often have an outsized impact on the pricing of the bonds. However, these prices rarely reflect the sentiment of the entire market and the buying and selling may not reflect the true underlying fundamentals of the market.

Retail investor sentiment may not have a tremendous impact on pricing volatility, but looking at the bigger picture, they help maintain the stability of the market. After all, many individual investors buy muni bonds to hold until maturity with a focus on the coupon rate. These dynamics could change moving forward, however, as financial institutions take an increasingly larger slice of the pie when it comes to aggregate muni bond holdings.

The Bottom Line

The municipal bond market is unique among many other bond markets due to the high volume of retail transactions. By comparison, the corporate bond market has just $750 billion in household and nonprofit holdings compared to $7.8 trillion for the financial sector. These dynamics suggest that retail investors may play a key role in maintaining the market’s stability, even though mutual funds tend to influence headline prices via their frequent trading.