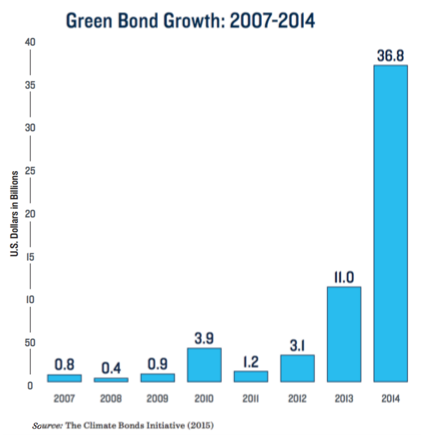

Impact investing has grown in popularity over the past several years as investors look for more than just a monetary return on their investment. While social impact bonds and microfinance have been the industry’s most popular vehicles in the past, the Climate Bonds Initiative has been betting on environmentally focused municipal bonds. These so-called green muni bonds grew from $100 million in 2013 to more than $30 billion in 2015.

Below, MunicipalBonds.com takes a closer look at the market for green muni bonds and why investors may want to consider adding them to their portfolio.

What Are Green Muni Bonds?

Green muni bonds are similar to traditional muni bonds with the exception that they are labeled “green” by their issuer and proceeds are earmarked for green investments. In addition, the issuer will track and report on the use of proceeds in order to ensure green compliance. There are no specific guidelines as to what constitutes a “green” investment, though there are universally accepted guidelines and third-party validation is highly encouraged.

There are four different types of green muni bonds.

- General Obligation Bonds: The State of California issued $300 million in Aa3/A green bonds to fund a variety of projects with repayment coming from personal income tax, sales and use tax, and corporate tax and full recourse to the issuer.

- Revenue Bonds: The Iowa Financial Authority issued $321.5 million of green revenue bonds that were backed by water-related fees and taxes and earmarked for water and wastewater projects with an AAA credit rating.

- Project Bonds: There are no examples of this type of bond issuance yet, but it would have recourse only to a specific project’s assets and revenue.

- Securitized Bonds: Hawaii issued $150 million of green asset-backed securities that were backed by a fee applied to state electricity customers, with the proceeds going to loans made to solar panels, connectors and storage companies.

Win-Win for Municipalities

United States infrastructure spending is expected to grow 3% from $700 billion in 2014 to more than $975 billion by 2025, according to Pricewaterhouse Cooper. With the government’s commitment to reduce carbon dioxide emissions by 32% from 2005 levels by 2030, these infrastructure investments could become low-hanging fruit for green investments since more than 60% of carbon emissions come from buildings and transportation systems. [

These investments are financed largely by the $3.7 trillion municipal bond market that attracts investors with its high credit quality and unique tax advantages relative to other bonds. By enabling this large group of existing investors to access social impact investments, the government could realize its climate-related goals in an efficient manner by directing infrastructure spending to more environmentally friendly projects.

The “green” status also helps attract investors. In 2014, Massachusetts issued traditional and green muni bonds with similar characteristics. The green muni bond was 3x oversubscribed and achieved a lower yield that was equivalent to AAA-rated securities. In addition, $260 million of the offering came from individual retail investors, which was significantly more than traditional muni bond offerings that are sold to institutions.

Investing in Green Muni Bonds

There are many reasons for investors to consider incorporating green muni bonds into their diversified portfolios. With similar yields and other characteristics to traditional muni bonds, there’s little reason to consider not investing in these beneficial projects. These bonds do suffer from the same risks as traditional muni bonds, however, such as higher interest rates that can increase yields and lower prices across all fixed-income asset classes.

Investors can find individual green muni bonds by asking their financial advisor to conduct a search for the appropriate issues. When it comes to municipal bonds, investors should generally seek out AMT-free bonds as a way to increase their after-tax yields. The tax advantages of individual bonds may also depend on a person’s state of residence and other factors, which means that investors should conduct their due diligence.

An easier way to invest in green muni bonds – along with other socially responsible investments – is through mutual funds and ETFs. While there are few pure-plays in the sector, these funds are a great way to build exposure to the green bonds without buying single bonds.

Popular mutual funds targeting the space include:

- TIAA-CREF’s Social Choice Bond Fund (TSBRX).

- Green Century’s Balanced Fund (GCBLX).

The Bottom Line

Green muni bonds are an emerging asset class that enables investors to support impact investing with the stability and attractiveness of the muni asset class. While the market is largely in its infancy, investors can expect its rapid growth to continue as the market seeks out investments that go beyond just monetary profits. A growing number of mutual funds and ETFs are also likely to enter the scene as capital flows into these types of bonds.