Municipal bonds have become extremely popular over the years due to their unique tax advantages. The tax-equivalent yields on muni bonds are often higher than comparable taxable bonds since they’re exempt from federal, state, and local income taxes.

For example, a 10-year muni bond yielding 2% has a tax-equivalent yield of 3% for bondholders who fall in the 35% federal income tax bracket. These yields could be even higher when factoring in state and local income taxes that vary widely between states.

The problem is that there’s a big difference between tax efficiency and after-tax returns that muni bondholders should carefully consider. There’s little doubt that muni bonds are tax-efficient given that they are exempt from income tax, but after-tax returns are an entirely different story that depend on alternative investments and an investor’s individual situation.

Below, MunicipalBonds.com takes a closer look at the difference between tax-efficiency and after-tax returns, as well as some other potential tax pitfalls facing muni bond investors.

Narrowing Tax Advantages

The goal for investors should be maximizing after-tax return rather than trying to achieve the highest tax efficiency. In other words, investors should forego a 10-year municipal bond yielding 2% if there’s a taxable bond yielding 4%, since the taxable bond’s yield is still higher than the muni bond’s 3% tax-equivalent yield.

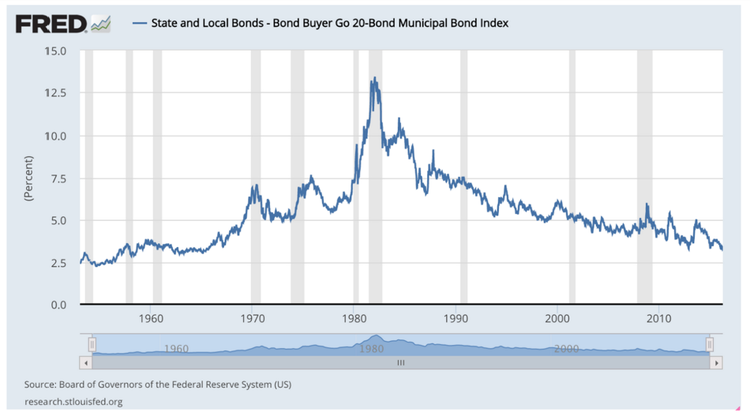

The growing popularity of muni bonds has led to higher prices and lower yields when compared to traditional taxable bonds. Figure 1 shows the falling yields of state and local 20-year general obligation bonds over time. Of course, these lower yields relative to traditional bonds means that tax-equivalent yields are moving closer to taxable yields.

These changes are particularly acute among investors who don’t fall in the top tax brackets since they realize less of a tax advantage. In these cases, the tax-equivalent yields are closer to the actual yields, which may further narrow the spread with traditional bond options.

Investors should be aware of these narrowing tax advantages when looking into muni bonds versus traditional bonds in order to maximize their after-tax returns.

Potential Muni Pitfalls

Municipal bondholders should be aware of potential tax pitfalls that could end up unexpectedly costing them money over the long term.

Muni bonds issued to finance private projects, such as airports and stadiums, could be subjected to the 28% alternative minimum tax (AMT). Many mutual funds and exchange-traded funds (ETFs) focus on holding AMT-free muni bonds to avoid these problems, but the situation can be a bit more confusing when investing in individual issues.

Investors must also be careful when purchasing muni bonds at a discount to face value. In these instances, bondholders may be required to pay income tax on bonds that they purchased for a discount of more than 0.25% for each year until maturity. This is because the investor is profiting from the bond’s pricing rather than the interest payments in these instances. Again, most funds avoid these problems, but they could become an issue for individual investors.

The Bottom Line

Municipal bonds have become enormously popular due to their unique tax advantages that exempt interest payments from federal, state, and local income tax. While there’s little doubt that muni bonds are tax-efficient investments, they may not always provide the highest after-tax returns, particularly as their popularity lowers yields. Investors should be mindful of the differences between tax efficiency and after-tax yields and seek to optimize the latter.

Muni bond funds avoid many of these problems and make for an easier comparison, although investors should still take the time to look at different options before investing.