Municipal bonds were among the top-performing investment classes last year, with the S&P Municipal Bond Index rising 3.14% and yielding more than 3%. Since 2009, muni bond yields have consistently risen amid record low interest rates across the developed world (see Figure 1) as investors sought out a combination of yield and safety. The big question among investors is whether or not these trends are poised to continue into 2016.

Below, MunicipalBonds.com takes a look at whether or not these trends are likely to continue given the Federal Reserve’s interest rate policy and key risk factors in some markets.

Where Are Interest Rates Headed?

The largest risk to municipal bonds is a steady rise in interest rates since prices move inversely to yields, which places the Federal Reserve in the driver’s seat.

The Federal Reserve has made it clear that it intends to steadily increase interest rates, but the financial markets remain skeptical of its proposed timeline. As of December 2015, the central bank intended on raising interest rates four times in 2016. This timeline was adjusted during the bank’s March 2016 meeting when officials pointed to “global economic and financial” risks and signaled that it would only hike interest rates twice this year.

The central bank’s next big move will be in June when most economists expect to see a modest rate hike. On Wall Street, traders have been a bit less optimistic that such a move will occur, putting the odds at just two in three. The good news is that inflation seems to be rising on its own thanks to a strong labor market and the stabilization of crude oil prices. In other words, the market may be taking care of the problem on its own without the central bank.

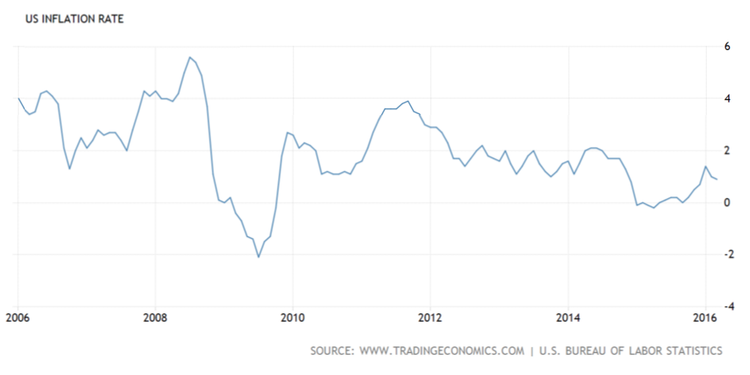

Muni bonds are considered defensive plays that are most sensitive to long-term interest rates rather than the short-term rates controlled by the central bank. These long-term rates usually only rise when the overall economy is growing at a pace that supports higher information. So far, inflation has failed to reach the central bank’s 2% target rate (see Figure 2), although there are signs that inflation expectations and real inflation could be on the uptick.

Potential Credit Risks Loom

The second largest risk to municipal bonds is credit risk in troubled municipalities, which has been an evolving concern over the past couple of years.

Puerto Rico’s debt crisis is the most obvious example of these risks. On May 1, the country will default on nearly $500 million in debt payments. The House of Representatives originally planned to address the issue by March 31, but the island territory won’t get any help from Washington in time for the May deadline. Regulators will be closely watching the financial market’s reaction, which could play a role in the ultimate resolution.

Puerto Rico may be the biggest problem facing the current market, but Chicago, Illinois, New Jersey, and Pennsylvania have added to the concern. For investors, the market has transformed from a rate-driven market like Treasuries to a credit-driven market like corporates. The old standard was that issuers able to pay debt would pay debt, but now, some issuers that end up in a budget crisis have opted to stop making payments to prioritize other spending.

These factors have only played a small role in influencing prices and yields to date – outside of Puerto Rico and similarly troubled municipalities. But over time, these risks could become much larger as municipalities struggle with constrained budgets.

The Bottom Line

The municipal bond market experienced a bumper year in 2015 and there are signs that it could continue into 2016. With the Federal Reserve pulling back on plans to hike interest rates four times this year, the interest rate risk facing the market has diminished to some extent. However, ongoing credit issues in areas like Puerto Rico could put pressure on some parts of the market over time. Investors can expect to see more volatility with an upward skew.