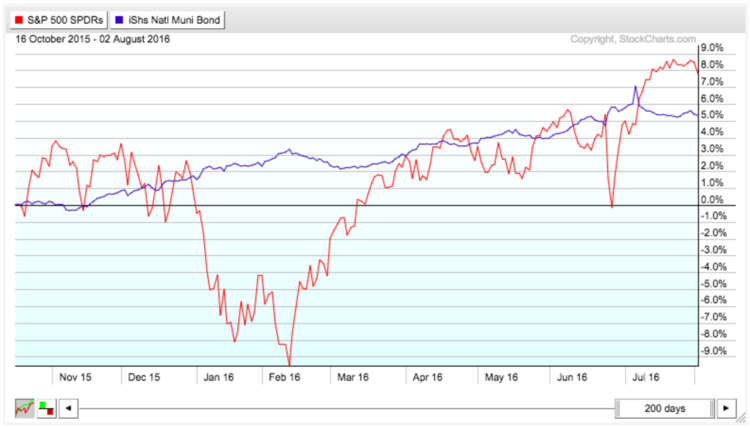

Municipal bonds have outperformed the S&P 500 over the past 52 weeks, while providing a higher and presumably safer yield. With equities trading at lofty valuations and yields falling lower, it shouldn’t come as a surprise that investors have been flocking into the asset class. But in July, muni bonds appear to have broken their one-year winning streak. State and local government debt lost 0.25% by late July, in its first monthly decline since June of 2015.

In this article, we will take a look at whether the drop in muni bonds is a temporary blip on the radar or part of a larger trend moving into the second half of 2016.

Reaction to “Brexit”

Britain’s decision to leave the European Union on June 23 led to a sell-off across global financial markets that had expected a “stay” vote. The FTSE 250 fell nearly 14% in just two days following the decision, while the S&P 500 dropped over 5% in the same time frame. A lot of that capital poured into safe-haven asset classes like municipal bonds, with the iShares S&P National AMT-Free Municipal Bond Fund (MUB) rising over 1% in the days after the vote.

Of course, the financial markets eventually decided that Brexit” would be a multi-year process and fears of immediate consequences were overhyped. The FTSE 250 and S&P 500 both regained their losses in the month since, but ETFs like MUB continued to rise through early July before starting to give back their gains. In fact, MUB reached a high of 115.19 on July 7, whereas the S&P 500 SPDRs (SPY) recouped its losses by June 30.

Many analysts believe that the downturn in the municipal bond market in July can be attributed to simply “giving back” some of the extraordinary gains following “Brexit”. While equity markets quickly recouped their losses by the end of June, the muni bond market extended its gains through early July before giving back those gains by the end of the month. These dynamics could suggest that the asset class is rebalancing, rather than entering a bear market.

Excessive Valuations

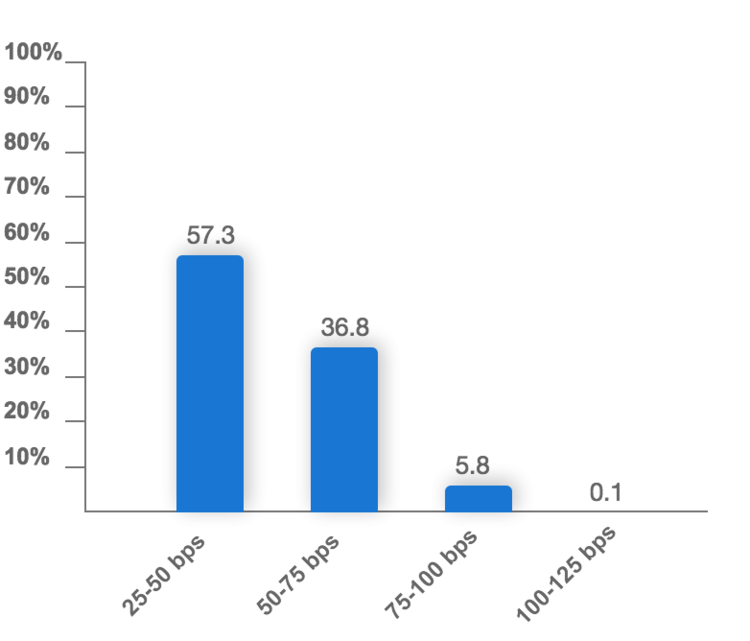

The Federal Reserve’s increasingly hawkish rhetoric could limit the upside price potential for the municipal bond market, according to analysts who predict a bear market for the asset class. According to the CME Group, the market is assigning 18% odds of a rate hike in September, 19% odds of a rate hike in November and 37% odds of a rate hike in December, which are much higher figures than in the past.

A Federal Reserve rate hike would have a negative impact on fixed income asset classes, including municipal bonds, although the impact on munis would be less acute. At the same time, many state and local governments have issued new muni bonds in an effort to lock-in low interest rates before a rate hike, which has translated to a worsening supply-demand situation that has put downward pressure on muni bond prices over time.

For now, Lipper U.S. Fund Flow data shows robust demand for the muni bond asset class with 42 straight weeks of capital inflows that reached $1 billion in the week ending July 20. It seems that many investors are willing to forego these risks in their efforts to seek out safe-haven assets and yields, particularly with growing risk-off sentiment in the market. The problem is that these trends could quickly reverse over the coming months with a rate hike looming.

The Bottom Line

Municipal bonds have been strong performers over the past 52 weeks, but July’s downturn has caused some anxiety in the market. While some analysts believe that the downturn is a temporary side-effect of “Brexit”, others point to mounting risks from the Federal Reserve’s hawkish undertones and potential plans to raise rates by year end. Investors should carefully assess these risks and consider adjusting their portfolio accordingly.