Municipal bonds have become extremely popular among investors – thanks to their tax-advantaged yields and perceived safe-haven status. With the possibility of an interest rate hike this year, municipalities have rushed to sell $272 billion worth of bonds so far in 2016, with Barclays plc analysts expecting as much as $400 billion in 2016. Democratic and Republican presidential candidates have also pledged to increase infrastructure spending in a move that could further drive muni issues in 2017 and beyond.

In this article, we look at the potential growth in infrastructure bonds and some important considerations for investors who are interested in them.

Infrastructure Could Drive New Issues

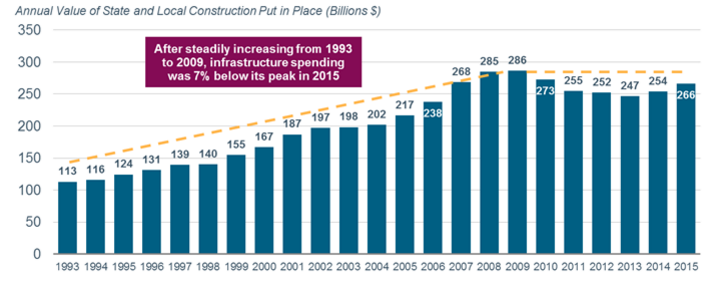

Infrastructure spending is sorely lacking in the United States, according to the American Society of Civil Engineers’ Report Card for America’s Infrastructure, which called for $3.6 trillion in spending by 2020 to modernize transportation, waterways and power generation. After a steady increase between 1993 and 2009, spending fell sharply and remains well below its peak levels of $286 billion in 2009 at just $266 billion in 2015.

Municipalities have been pocketing savings by refinancing rather than investing in new projects since the recession ended in 2009. So far this year, roughly 40% of bond issues came from new-money sales compared to just 35% last year, according to Merrill Lynch analysts. Growing demand for muni bonds on the part of investors has driven down yields to unprecedented levels, which has finally encouraged the switch to new-money spending.

Investing in Infrastructure Bonds

Infrastructure bonds are a type of revenue bond, which differs from general obligation (GO) bonds. While general obligation bonds are backed by taxpayer dollars, revenue bonds rely on payments from specific projects to pay off bondholders. These attributes make them riskier than GO bonds in many cases, since there is business risk involved that influences their ability to make timely payments to bondholders over time.

When looking at these bonds, conservative investors may want to limit their search to utility-focused bonds that have more predictable cash flow. Water and sewer bonds are a great example since they are services that end users can’t live without. The credit quality of these bonds tends to be higher than other revenue bonds, although there are slightly lower yields associated with them due to the diminished risk factors.

Investors willing to assume a bit more risk may want to consider transportation bonds that are backed by things like toll roads or airport fees. These are the most popular type of revenue bond and account for over 15% of total issues, while offering a relatively attractive yield and credit rating over an average 15-year maturity. The most speculative revenue bonds are often hospital and leasing bonds, which face much less predictable revenue over time.

The Bottom Line

The municipal bond market has benefited from strong demand on the part of investors seeking yield, which has led to an increasing number of new issues this year. With municipalities transitioning from refinancing to new money, investors can expect to see a lot more opportunities hit the market, particularly from infrastructure revenue bonds. These bonds offer higher yields in exchange for taking on modestly higher risk than typical GO bonds.

Investors should keep in mind the differences between various infrastructure bonds when making a buying decision. Risk-averse investors may want to stick to utilities like water and sewer bonds, while investors seeking higher yields can look at transportation bonds or even hospital and leasing bonds as alternatives.