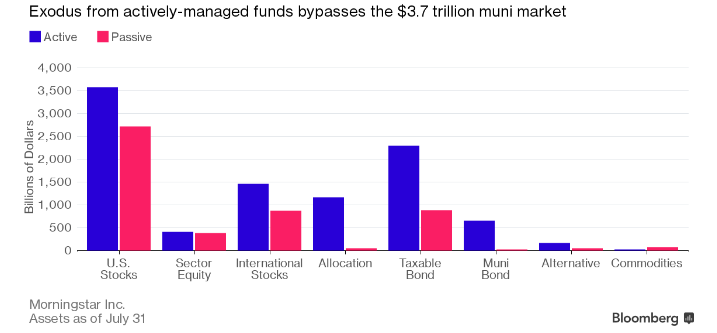

Most investors have embraced passive index investing as a way to reduce costs and improve long-term returns. But, municipal bond funds have been an exception. The vast majority of muni bond funds are actively managed, despite nearly half faring worse than their tax-exempt benchmark indexes. Surprisingly, nearly $50 billion flowed into actively managed muni bond funds in the 12-month period through July 2016, according to Bloomberg.

In this article, we’ll look at why actively managed muni bond funds have succeeded in attracting capital, and whether investors should reassess their portfolios.

Passive Outperforms

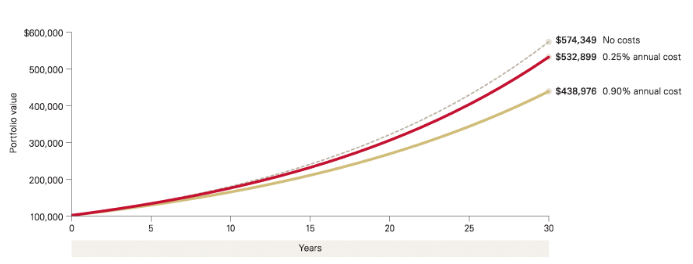

There’s little doubt that passively managed index funds tend to outperform their actively managed counterparts. The iShares National Muni Bond ETF (MUB) outperformed more than 70% of national intermediate active managers over a 1- to 3-year period, according to Bloomberg data, with an expense ratio of just 0.25%. By comparison, the average actively managed open-end muni bond mutual fund charges upwards of 0.9%, according to Morningstar.

Passively managed funds benefit from greater diversification and lower expenses than many actively managed funds. According to Vanguard, a leader in passive indexing, lower costs translate to a greater share of an investment’s return. And, research suggests that lower-cost investments have tended to outperform higher-cost alternatives over time. In other words, you can’t control the market, but you can control the costs charged by funds.

The prevalence of actively managed muni bond funds may be due to financial advisors that tend to sell actively managed bond funds more than equity funds. Many advisors and clients have less of an understanding of bonds and bond funds than equities and equity funds. The expense ratios of actively managed bond funds also tend to be lower than those of actively managed equity funds, which could make the expense more palatable for investors.

Benefits of Active

There are important benefits actively managed municipal bond funds provide that passively managed funds might not be able to match. While these benefits may be debatable, they also may be worth considering for investors involved in the muni bond market.

First, many investors prefer to buy bonds issued by their local governments or state-specific funds if they live in high-tax states. Since most passively managed index funds are nationally focused, this means that actively managed funds may be the best alternative. The downside is that these funds tend to have higher fees that can eat into the benefits achieved by isolating tax advantages on a local municipality or state-to-state basis.

Second, many investors look for managers who are doing credit research, adjusting for duration and avoiding potential issues. Puerto Rico’s debt crisis provides a great example of why these attributes can be important. Passively managed funds may be required to hold Puerto Rican bonds, depending on their indexing methodology, whereas actively managed funds have the ability to avoid these potentially risky assets.

The Bottom Line

Most investors are well aware of the benefits of passive index investing as a way to reduce expenses and realize greater overall returns. While this is certainly the case when it comes to equities, municipal bonds remain dominated by actively managed funds for a variety of reasons. Some of these reasons may be valid, such as state-specific targeting or enhanced credit research, but investors may want to take a closer look at their individual rationale.