This article originally appeared on the Muni Nation blog at VanEck.com.

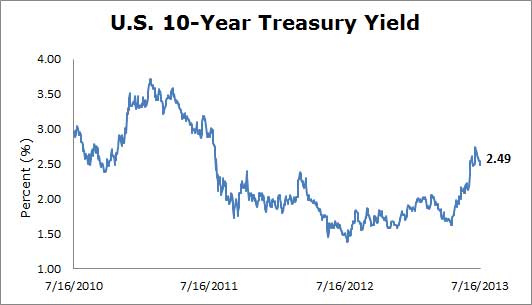

Despite recent events in Detroit, I believe the famously coined term "green shoots" is an apt descriptor for the municipal bond market at this present time. Having been scorched by the wildfire correction that engulfed the fixed-income markets since the end of April, as evidenced by the sharp rise in interest rates (represented in the graph below), there now seems to be indication of a broadening of support for munis from the retail/registered investment advisor community. I have seen inquiries coming from dealers looking for bonds across the spectrum indeed a welcome sight. The question remains: When does this become an embedded strategy that brings assets back to mutual funds and ETFs?

Source: FactSet as of July 19, 2013.

Two weeks ago, I observed that opportunistic investors (e.g., non-traditional and hedge fund) stepped into the breach and provided added liquidity for individual bonds that were burdensome to dealers balance sheets. As has happened in the past two periods of strained liquidity (2008 and 2010), these investors captured great values which, in my view, were in part represented by some of the deep discounts shown by the intraday marks on the muni ETFs. I view this "intervention" strategy as having been born out of the introduction of Build America Bonds, which I believe brought many more portfolio eyes to focus on the municipal bond market and on its unique qualities as a destination for valuable tactical trades during times of stress. Bernanke's testimony notwithstanding, I am hoping for a period of calm and consolidation so the muni bond fund community can re-establish a credible reinvestment strategy.