The municipal bond market moved lower in October as issuers rushed to lock in low interest rates before the Federal Reserve’s December rate decision. In fact, October was the single largest issuance month since December 1985 with $53 billion in new bonds hitting the market.

The increase in supply came at a time when traditional buyers retreated from the market due to recent lackluster performance, which contributed to lower prices and higher yields.

In this article, we will take a look at ways to identify certain types of muni bonds you should avoid at all costs.

Factor in Interest Rate Sensitivity When Choosing the Investment Horizon

The Federal Reserve is widely expected to raise interest rates to a 50 to 75 basis point range during its December 14 meeting. According to CME Group data from November 10, the futures market predicts a 76.3% chance of an interest rate hike and only a 23.7% chance of keeping rates steady.

Bond prices are inversely correlated with yields since bonds with above- or below-market yields must be marked up or discounted when interest rates change. Rising interest rates tend to affect long-term bonds the most since investors are “locked in” to below-market yields for a longer period of time.

Let’s take a look at an example to understand this.

| Bond Issuer | CUSIP Number | Maturity (Years) | Impact of +25 BPS |

|---|---|---|---|

| Metropolitan Washington DC Airports | 592643CC2 | 37 | -4.04% |

| San Antonio Texas Independent School District | 796269TV0 | 5 | -1.09% |

Here, the 37-year bond would fall more than 4% if interest rates increased by 25 bps compared to just a 1% fall for a 5-year bond under the same circumstances. To view other muni bond trades, access our Market Activity section.

There are two core concepts that investors should understand when it comes to the impact of interest rates on bond prices and yields. A bond’s duration measures its sensitivity to changes in interest rates in a linear fashion, while convexity looks at the rate of change of duration in order to more accurately quantify the relationship between prices and interest rates. In general, investors should seek bonds with low duration and high convexity. Click here to learn more about these two concepts.

Muni Bond Credit Ratings Require Careful Investigation

Municipal bond defaults have been considerably lower than corporate bonds, but investors shouldn’t discount credit risk when analyzing these bonds.

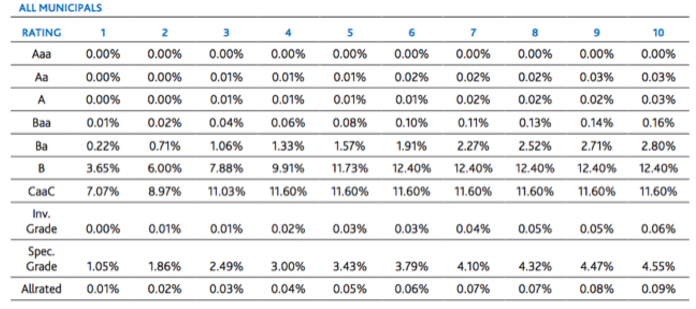

In the above figure, investors should note that AAA rated bonds have had no defaults, while lower rated bonds tend to see higher defaults. BAA bonds have had a relatively low default rate of 0.16%, while “junk” bonds have had much higher default rates of more than 10%. It’s also worth noting that default rates have tended to increase over time.

Puerto Rico’s high-profile default (read this article to learn more about that default) on general obligation bonds and pension struggles have highlighted credit risks in recent years. This default also suggests that credit reports do not reflect current risk factors because they tend to lag actual credit events. As a result, investors should also focus on additional factors like growing pension obligations that could take cash flow away from bond repayment as well as other cash flow challenges.

Ways to Narrow Down on the Right Muni Instrument

Municipal bond investors should seek out high-quality bonds with low exposure to rising interest rates in order to reduce the odds of a catastrophic default or a significant drop in value from rising interest rates in December.

In particular, investors may want to avoid the following types of muni bonds:

- Long-term bonds funding non-essential services: The Miami Marlins’ Stadium Parking Revenue bond (593372AD7) offers an attractive 7.443% yield. However, the bond that matures in 2027 has relatively high credit risk because revenues are completely dependent on the stadium’s popularity.

- Long-term bonds issued by less creditworthy municipalities: Illinois State bond (452152D73) is backed by the troubled state of Illinois and matures in 2030, exposing investors to relatively high-interest rate risk.

- Short-term bonds issued by less creditworthy municipalities: New Jersey School bond (4765755N1) expires in 2020, but remains risky due to the shaky financial condition of the city and state.

There are some circumstances where investors might prefer to purchase these bonds or refuse to sell them. In these cases, it’s generally a good idea to try and diversify a portfolio to reduce the risk of any individual bond impacting an entire portfolio. For instance, investors can consider MUB and PWZ as two potential muni bond ETFs that offer national and regional-level diversification to muni investors, respectively.

Some bonds in troubled municipalities may also offer insurance, which reduces the risk of loss in the event of a default if an investor holds the bond through maturity rather than selling at a depressed market price.

The Bottom Line

Municipal bond investors should generally try to purchase high-quality bonds with shorter maturities in order to mitigate the potential impact of higher interest rates. At the same time, investors should avoid long-term bonds funding non-essential services or issued by less creditworthy municipalities. Any bonds issued by highly troubled municipalities, such as Puerto Rico or Illinois, should also be avoided by those looking to minimize risk.

To stay up to date with other muni bond investment strategies, visit this page.